############## package

library(lmtest) ##DW test

library(ggplot2)

library(lubridate)

library(gridExtra)해당 자료는 전북대학교 이영미 교수님 2023고급시계열분석 자료임

패키지 설치

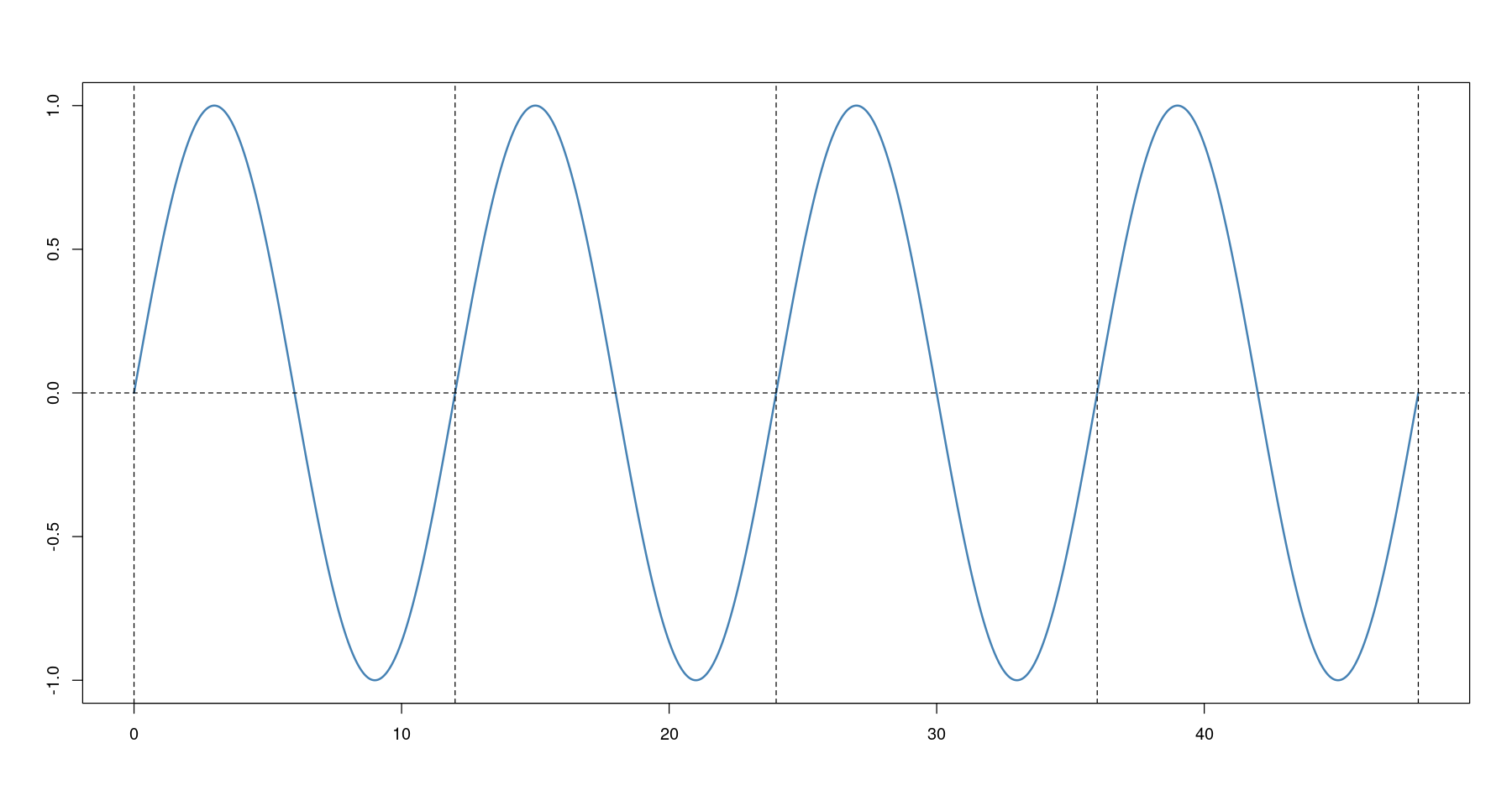

options(repr.plot.width = 15, repr.plot.height = 8)삼각함수 그려보기

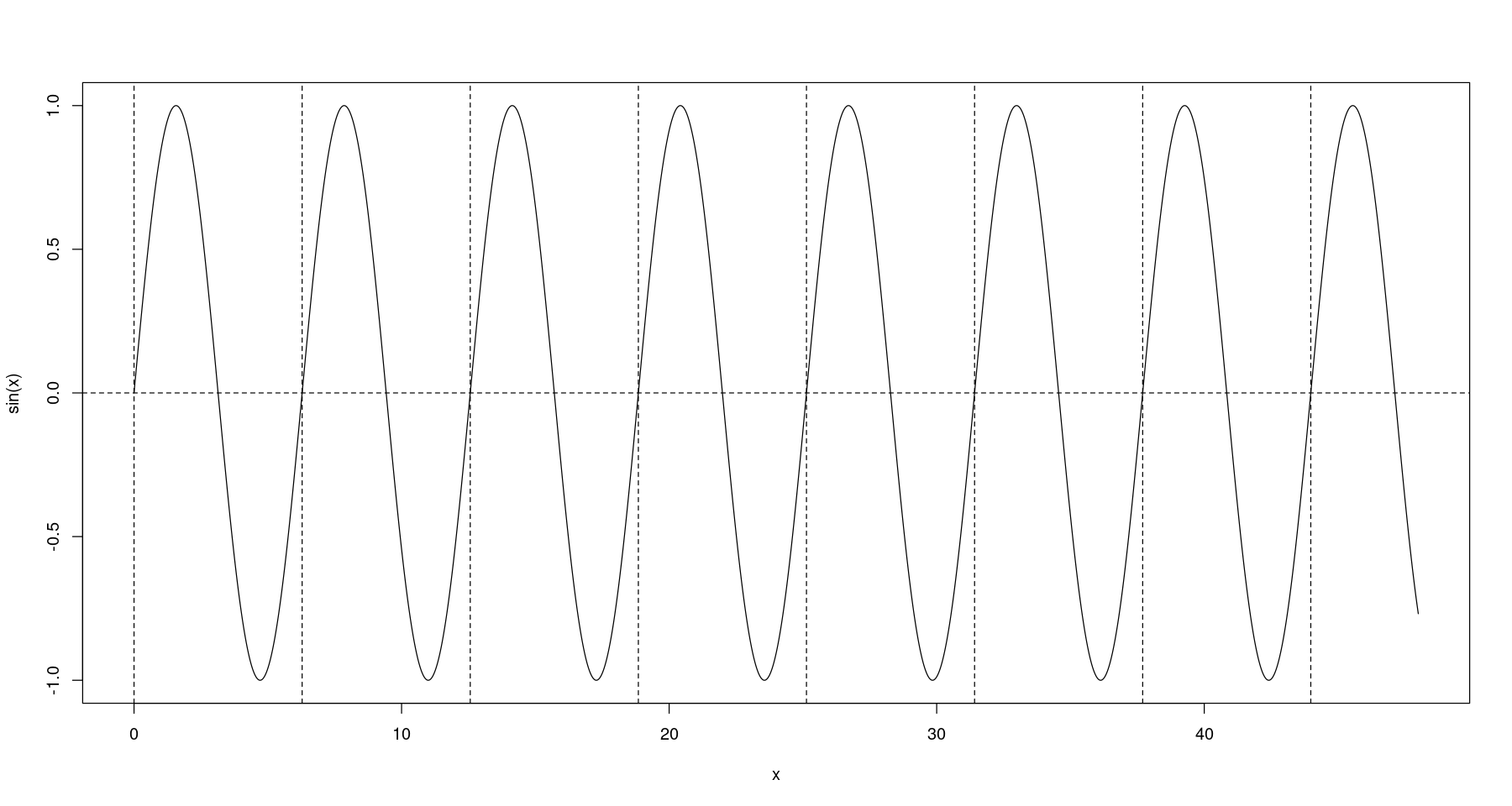

- \(sin(x)\): 주기가 2\(\pi\)인 주기 함수

x <- seq(0,48,0.01)plot(x, sin(x), type='l')

abline(h=0, lty=2)

abline(v=seq(0,48, by = 2*pi), lty=2)

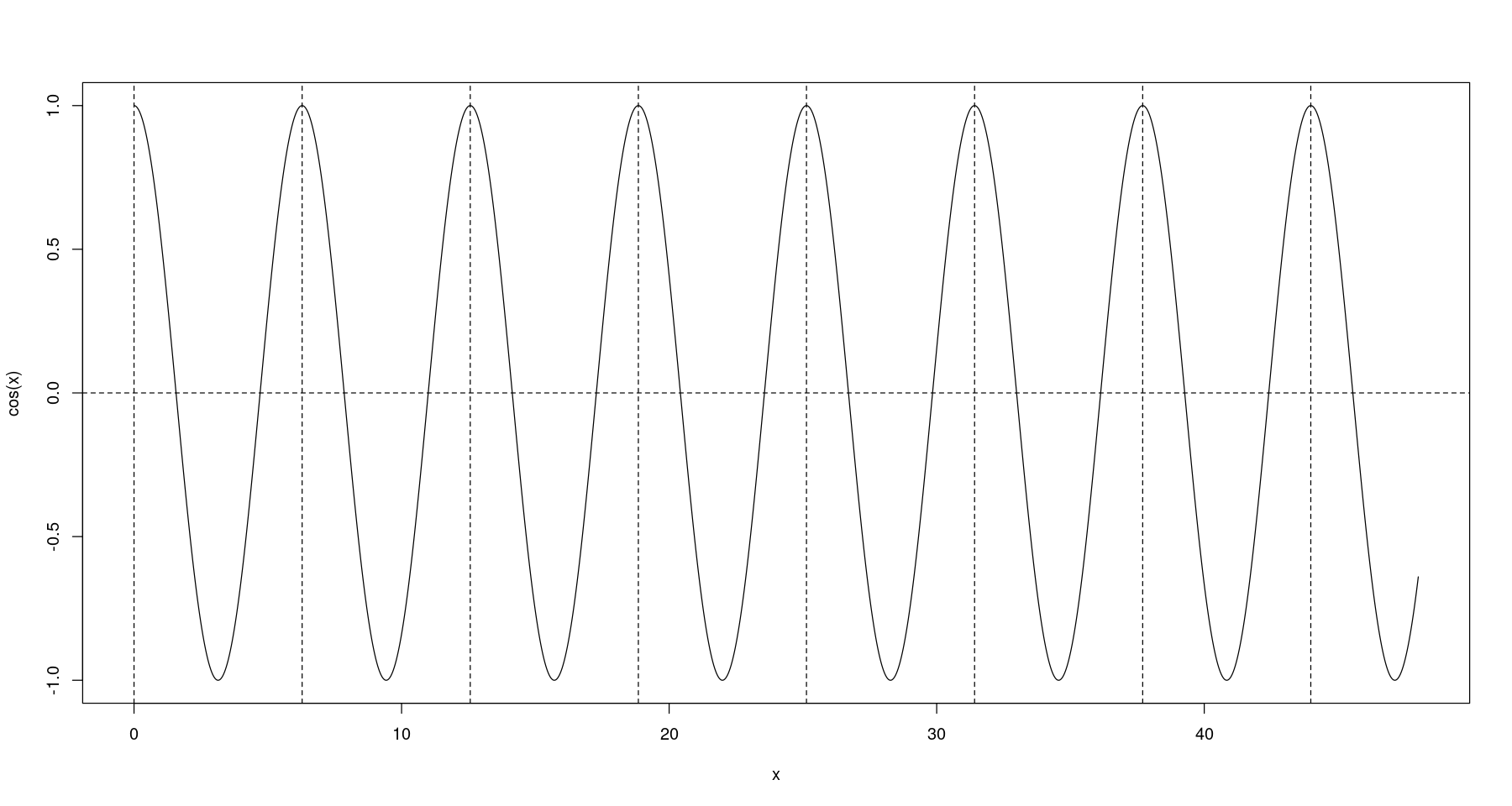

- \(cos(x)\): 주기가 2\(\pi\)인 주기 함수

plot(x, cos(x), type='l')

abline(h=0, lty=2)

abline(v=seq(0,48, by = 2*pi), lty=2)

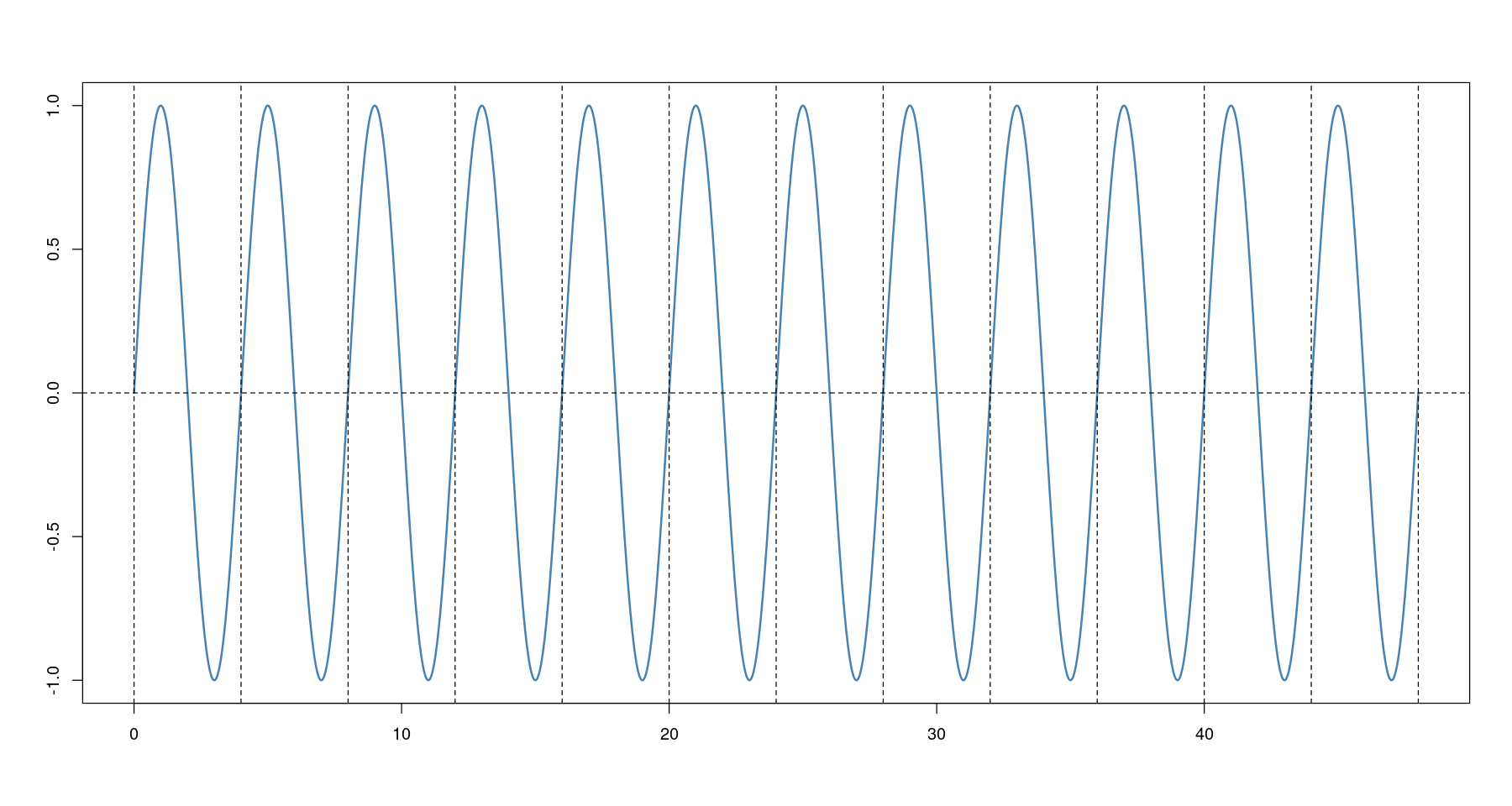

- 정리..

- sin(x): 주기 2\(\pi\)

- sin(2x): 주기 2\(\pi\)/2 = \(\pi\)

- sin(3x): 주기 2\(\pi\)/3

- sin(\(\pi\)x): 주기 2\(\pi\)/\(\pi\) = 2

- sin(\(\pi\)x/6): 주기 12

주기를 s로 바꾸고 싶다면, s = 2 \(\pi\) / x => x = 2\(\pi\)s

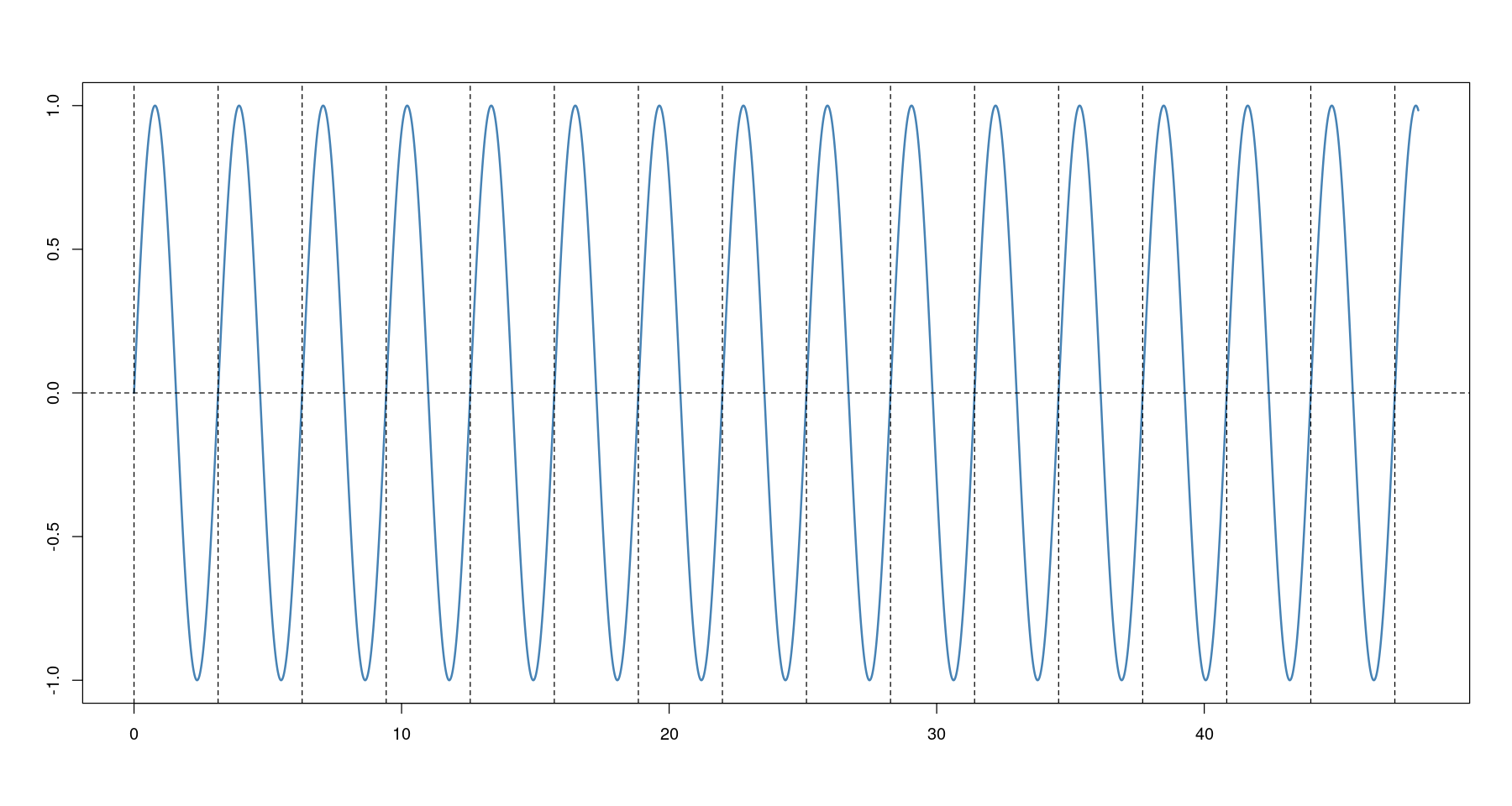

- sin 함수의 주기 변동

# 주기 = pi

plot(x, sin(2*x), type='l', col='steelblue', lwd=2,

xlab="", ylab="")

abline(h=0, lty=2)

abline(v= seq(0, 48, by=pi), lty=2)

# 주기 = 12

s <- 12

plot(x, sin(2*pi*x/s), type='l', col='steelblue', lwd=2,

xlab="", ylab="")

abline(h=0, lty=2)

abline(v= seq(0, 48, by=s), lty=2)

# 주기 = 4

s <- 4

plot(x, sin(2*pi*x/s), type='l', col='steelblue', lwd=2,

xlab="", ylab="")

abline(h=0, lty=2)

abline(v= seq(0, 48, by=s), lty=2)

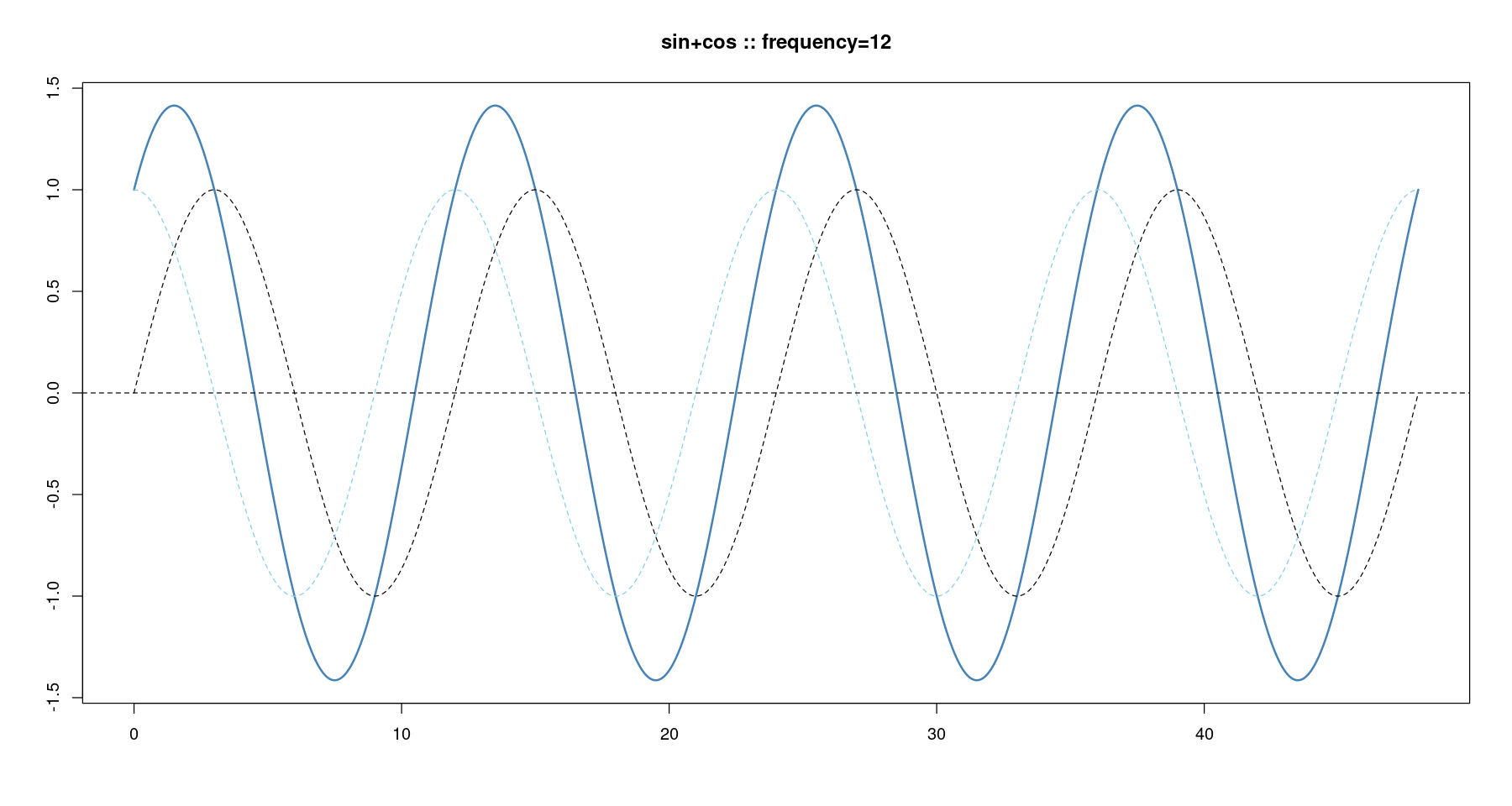

- sin + cos

s <- 12

plot(x, sin(2*pi*x/s)+cos(2*pi*x/s), type='l', col='steelblue', lwd=2,

xlab="", ylab="", main=paste0('sin+cos :: ', "frequency=", s))

lines(x, sin(2*pi*x/s), col='grey1', lty=2)

lines(x, cos(2*pi*x/s), col='skyblue', lty=2)

abline(h=0, lty=2)

#abline(v= seq(0, 48, by=s), lty=2)

#abline(v= seq(1.5, 48, by=s), lty=2)

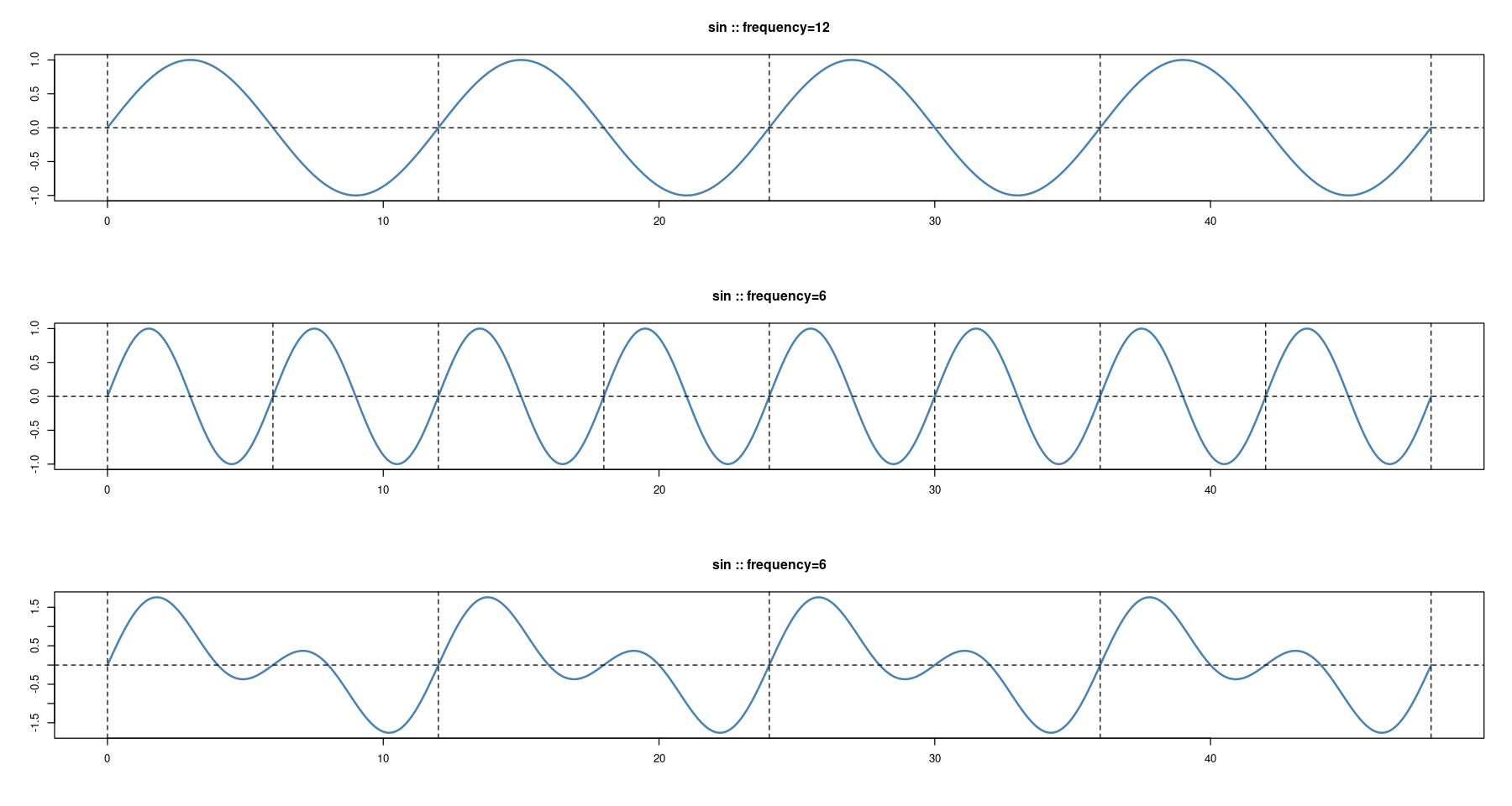

- 여러 주기의 함수 합치기

- 주기가 12, 6인 sin함수 더하기: sin\(\left(\dfrac{2 \pi t}{12} \right)\) + sin\(\left(\dfrac{2 \pi t}{6} \right)\)

par(mfrow=c(3,1))

s<-12

plot(x, sin(2*pi*x/s), type='l', col='steelblue', lwd=2,

xlab="", ylab="", main=paste0('sin :: ', "frequency=", s))

abline(h=0, lty=2)

abline(v= seq(0, 48, by=s), lty=2)

s<-6

plot(x, sin(2*pi*x/s), type='l', col='steelblue', lwd=2,

xlab="", ylab="", main=paste0('sin :: ', "frequency=", s))

abline(h=0, lty=2)

abline(v= seq(0, 48, by=s), lty=2)

plot(x, sin(2*pi*x/12)+sin(2*pi*x/6), type='l', col='steelblue', lwd=2,

xlab="", ylab="", main=paste0('sin :: ', "frequency=", s))

abline(h=0, lty=2)

abline(v= seq(0, 48, by=12), lty=2)

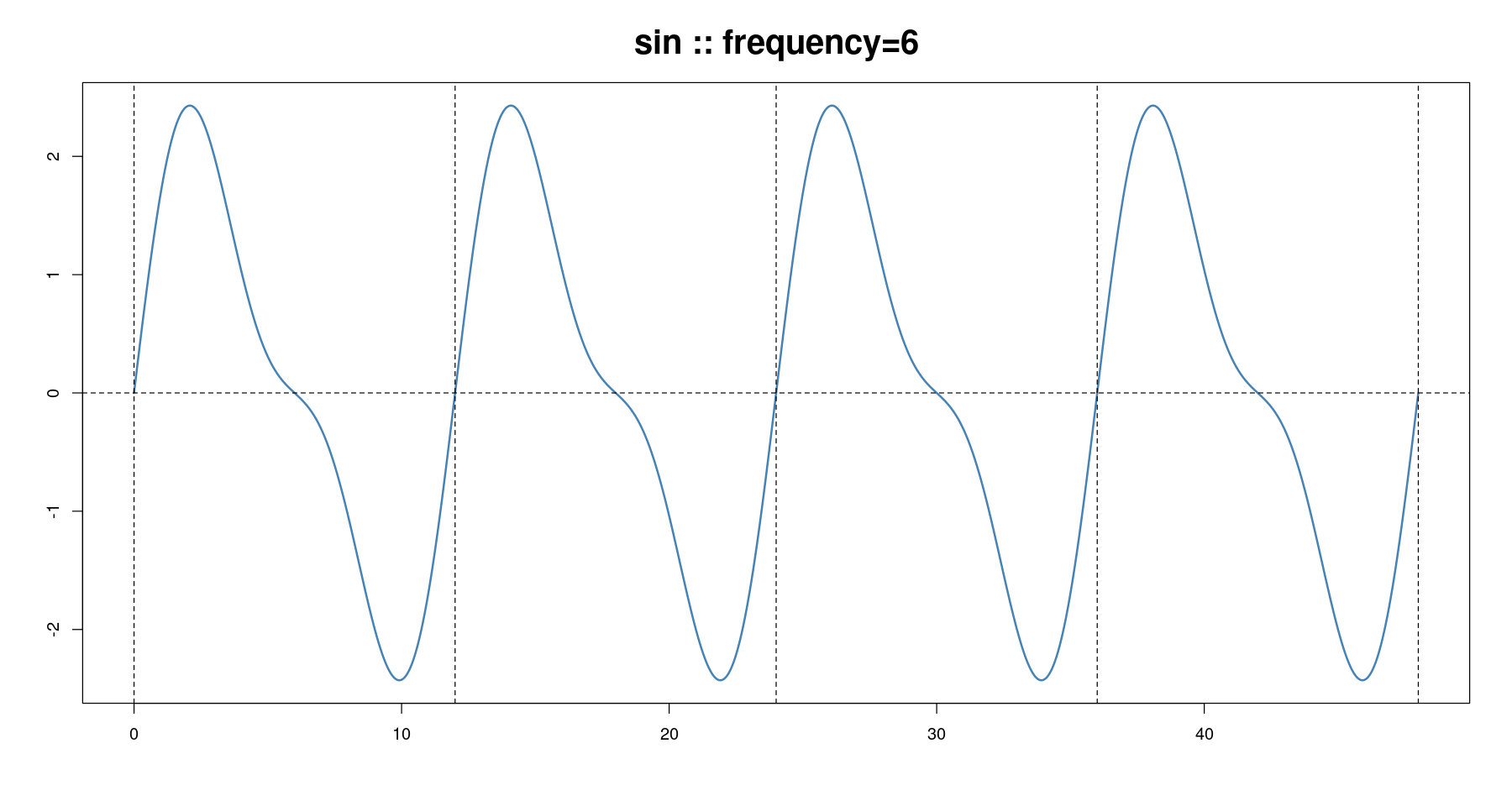

- 주기가 12, 6인 sin함수 더하기: \(2sin \left(\dfrac{2 \pi t}{12} \right)\) + \(0.8sin\left(\dfrac{2 \pi t}{6} \right)\)

plot(x, 2*sin(2*pi*x/12)+0.8*sin(2*pi*x/6), type='l', col='steelblue', lwd=2,

xlab="", ylab="", main=paste0('sin :: ', "frequency=", s),cex.main=2)

abline(h=0, lty=2)

abline(v= seq(0, 48, by=12), lty=2)

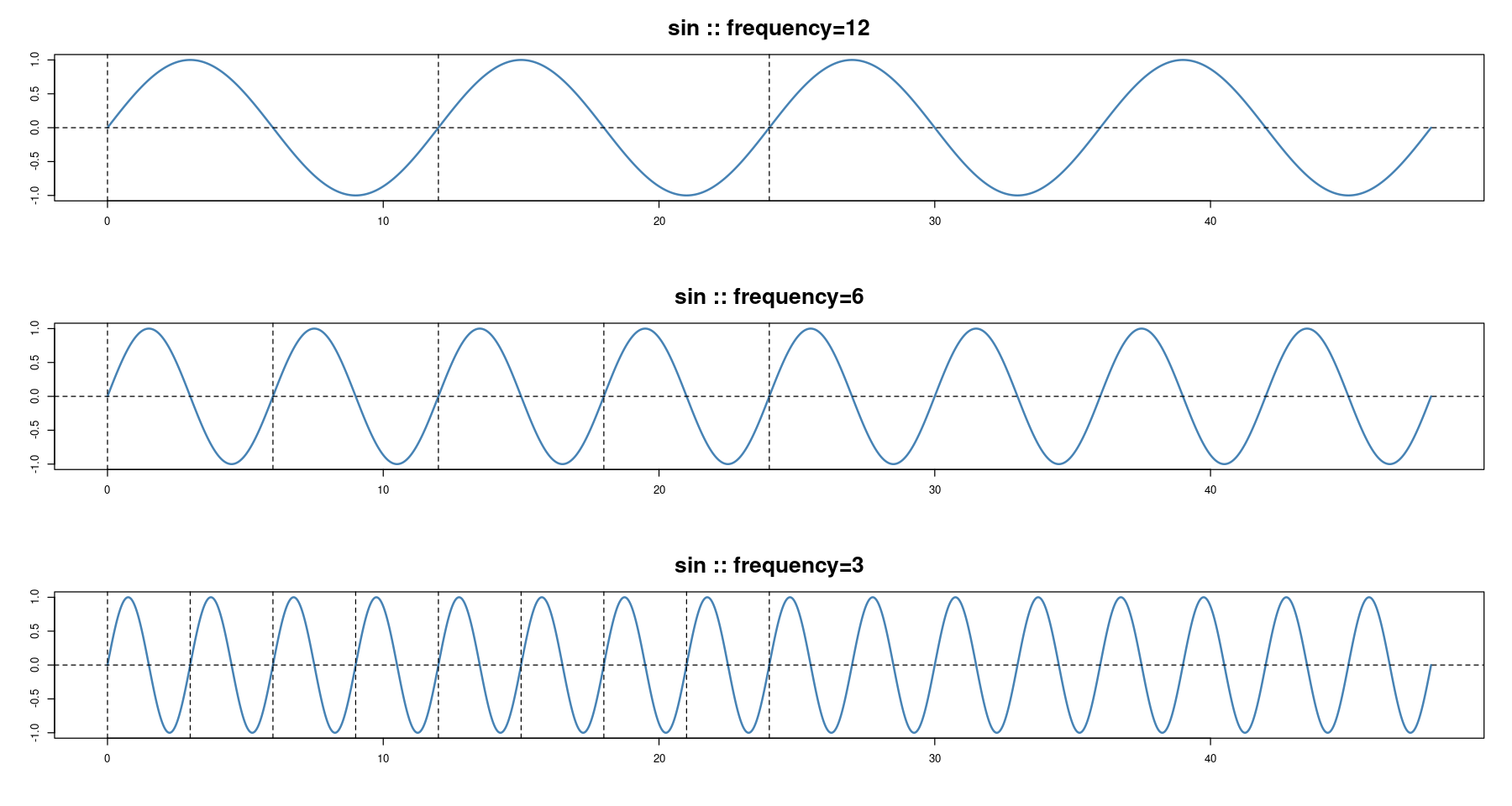

- 주기가 12, 6, 3인 sin함수 더하기: \(sin \left(\dfrac{2 \pi t}{12} \right)\) + \(sin\left(\dfrac{2 \pi t}{6} \right)\) + \(sin\left(\dfrac{2 \pi t}{3} \right)\)

par(mfrow=c(3,1))

s<-12

plot(x, sin(2*pi*x/s), type='l', col='steelblue', lwd=2,

xlab="", ylab="", main=paste0('sin :: ', "frequency=", s),cex.main=2)

abline(h=0, lty=2)

abline(v= seq(0, 24, by=s), lty=2)

s<-6

plot(x, sin(2*pi*x/s), type='l', col='steelblue', lwd=2,

xlab="", ylab="", main=paste0('sin :: ', "frequency=", s),cex.main=2)

abline(h=0, lty=2)

abline(v= seq(0, 24, by=s), lty=2)

s<-3

plot(x, sin(2*pi*x/s), type='l', col='steelblue', lwd=2,

xlab="", ylab="", main=paste0('sin :: ', "frequency=", s),cex.main=2)

abline(h=0, lty=2)

abline(v= seq(0, 24, by=s), lty=2)

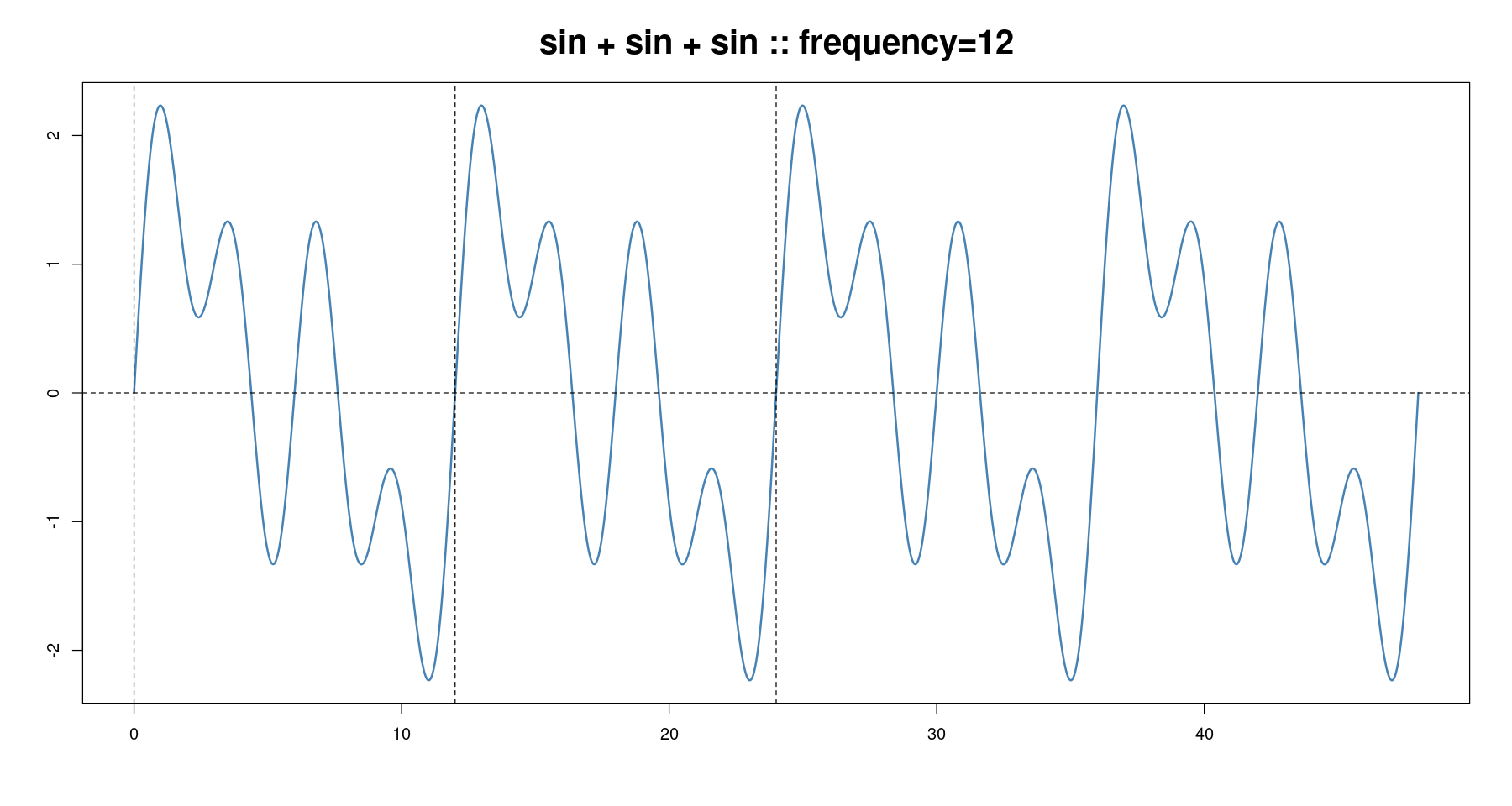

plot(x, sin(2*pi*x/12)+sin(2*pi*x/6)+sin(2*pi*x/3), type='l', col='steelblue', lwd=2,

xlab="", ylab="", main=paste0('sin + sin + sin :: ', "frequency=", 12),cex.main=2)

abline(h=0, lty=2)

abline(v= seq(0, 24, by=12), lty=2)

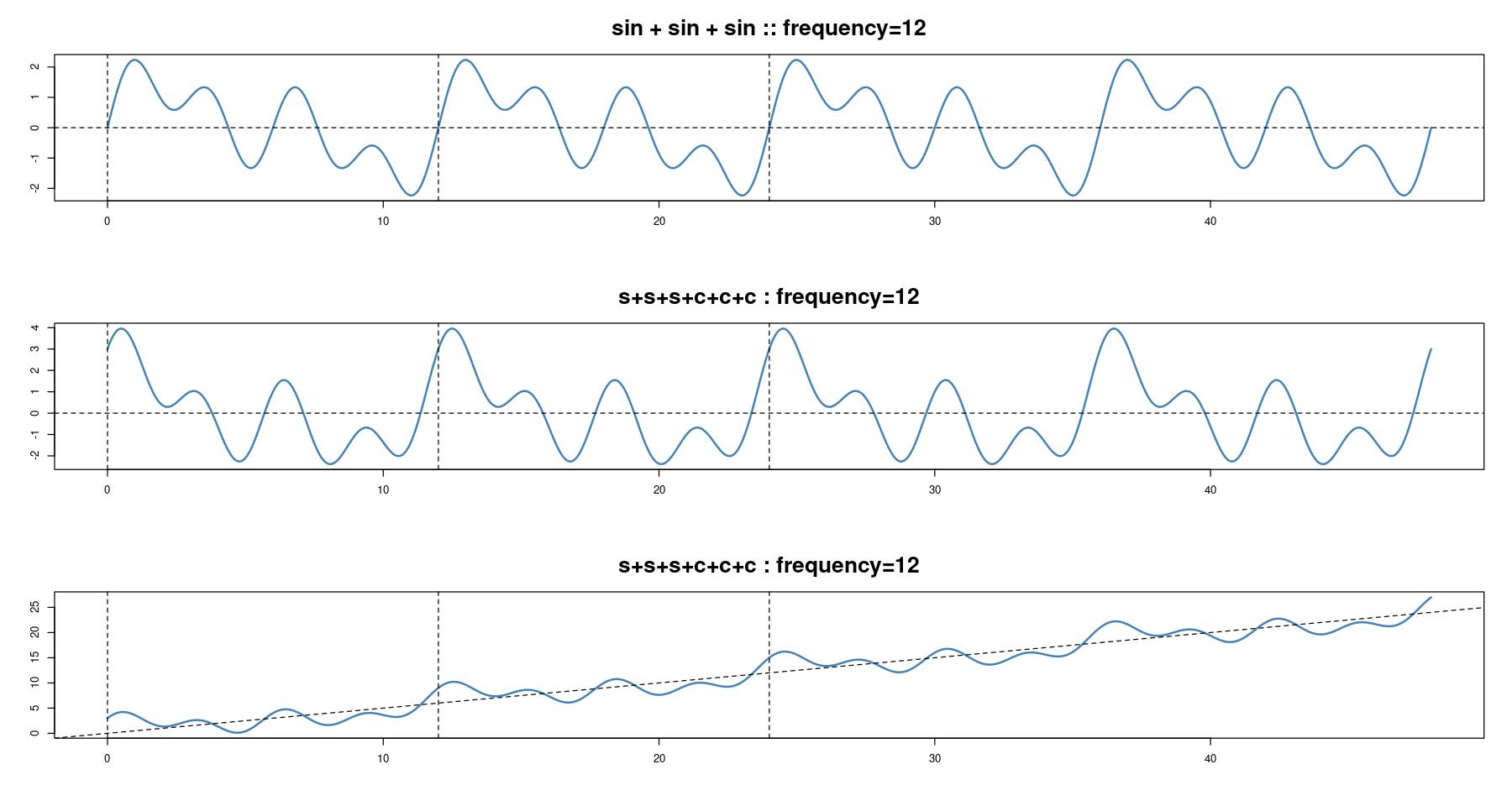

- 주기와 추세가 모두 있는 경우

par(mfrow=c(3,1))

plot(x, sin(2*pi*x/12)+sin(2*pi*x/6)+sin(2*pi*x/3),

type='l', col='steelblue', lwd=2,

xlab="", ylab="", main=paste0('sin + sin + sin :: ', "frequency=", 12), cex.main=2)

abline(h=0, lty=2)

abline(v= seq(0, 24, by=12), lty=2)

y <- sin(2*pi*x/12)+sin(2*pi*x/6)+sin(2*pi*x/3)+

cos(2*pi*x/12)+cos(2*pi*x/6)+cos(2*pi*x/3)

plot(x,y, type='l', col='steelblue', lwd=2,

xlab="", ylab="", main="s+s+s+c+c+c : frequency=12", cex.main=2)

abline(h=0, lty=2)

abline(v= seq(0, 24, by=12), lty=2)

y2 <- x*0.5 + sin(2*pi*x/12)+sin(2*pi*x/6)+sin(2*pi*x/3)+

cos(2*pi*x/12)+cos(2*pi*x/6)+cos(2*pi*x/3)

plot(x,y2, type='l', col='steelblue', lwd=2,

xlab="", ylab="", main="s+s+s+c+c+c : frequency=12", cex.main=2)

abline(a = 0, b = 0.5, lty=2)

abline(v= seq(0, 24, by=12), lty=2)

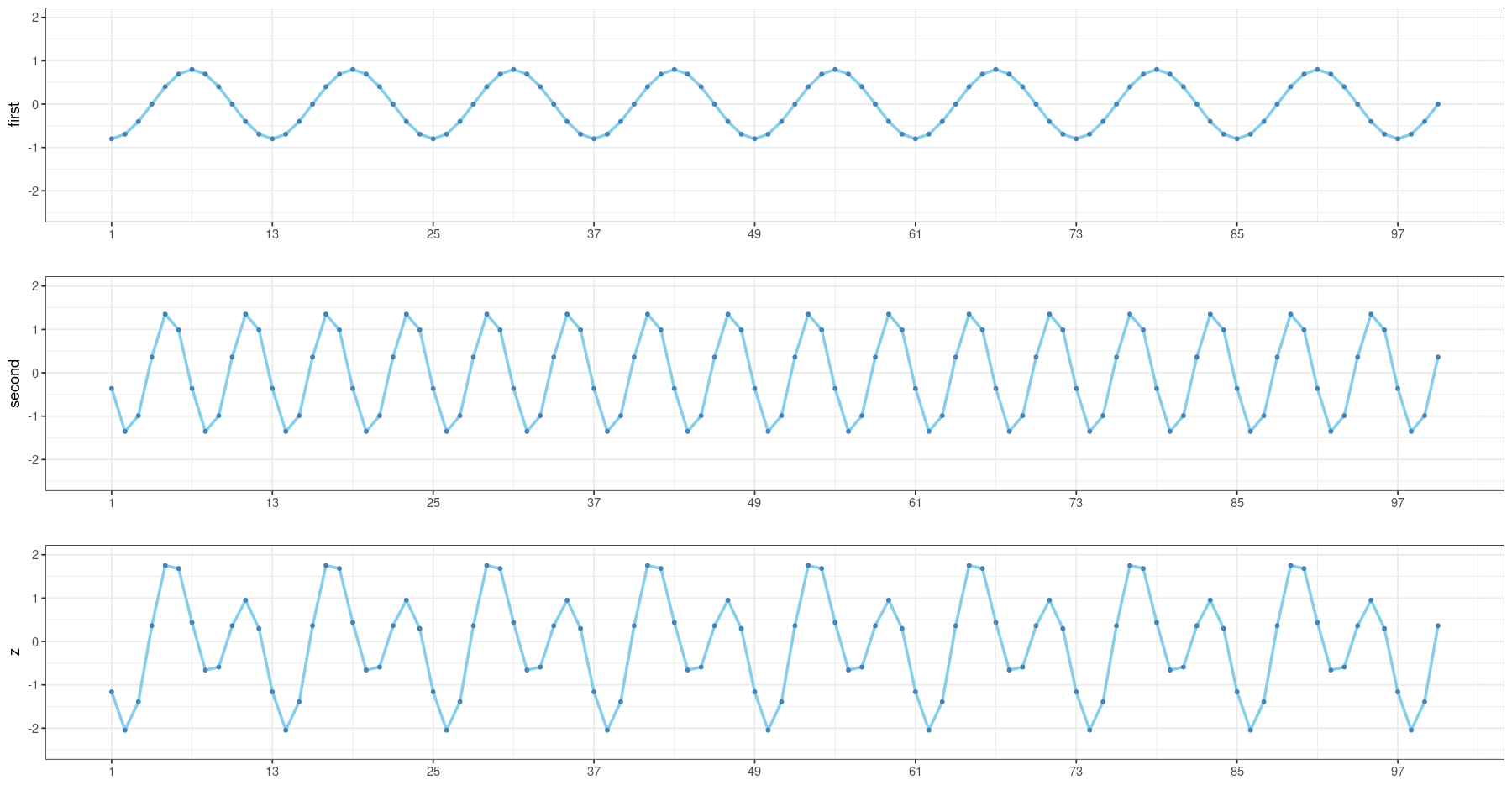

- 강의노트에 있는 그림

n <- 100;

t <- 1:n

a1 <- -0.8;

a2 <- 1.4

phi1 <- pi/3;

phi2 <- 3*pi/4

first <- a1*sin(pi*t/6+phi1) # 첫 번째 주기성분

second <- a2*sin(pi*t/3+phi2) # 두 번째 주기성분

dt <- data.frame(t=t,

first = first,

second=second,

z = first+second)

p1 <- ggplot(dt, aes(t,first)) + geom_line(col='skyblue', size=1) +

geom_point(col='steelblue', size=1)+

ylim(-2.5,2)+xlab("")+

scale_x_continuous(breaks = seq(1,100, by = 12))+

theme_bw()

p2 <- ggplot(dt, aes(t,second)) + geom_line(col='skyblue', size=1) +

geom_point(col='steelblue', size=1)+

ylim(-2.5,2)+xlab("")+

scale_x_continuous(breaks = seq(1,100, by = 12))+

theme_bw()

p3 <- ggplot(dt, aes(t,z)) + geom_line(col='skyblue', size=1) +

geom_point(col='steelblue', size=1)+

scale_x_continuous(breaks = seq(1,100, by = 12))+

ylim(-2.5,2)+xlab("")+

theme_bw()

grid.arrange(p1, p2, p3, nrow = 3)Warning message:

“Using `size` aesthetic for lines was deprecated in ggplot2 3.4.0.

ℹ Please use `linewidth` instead.”

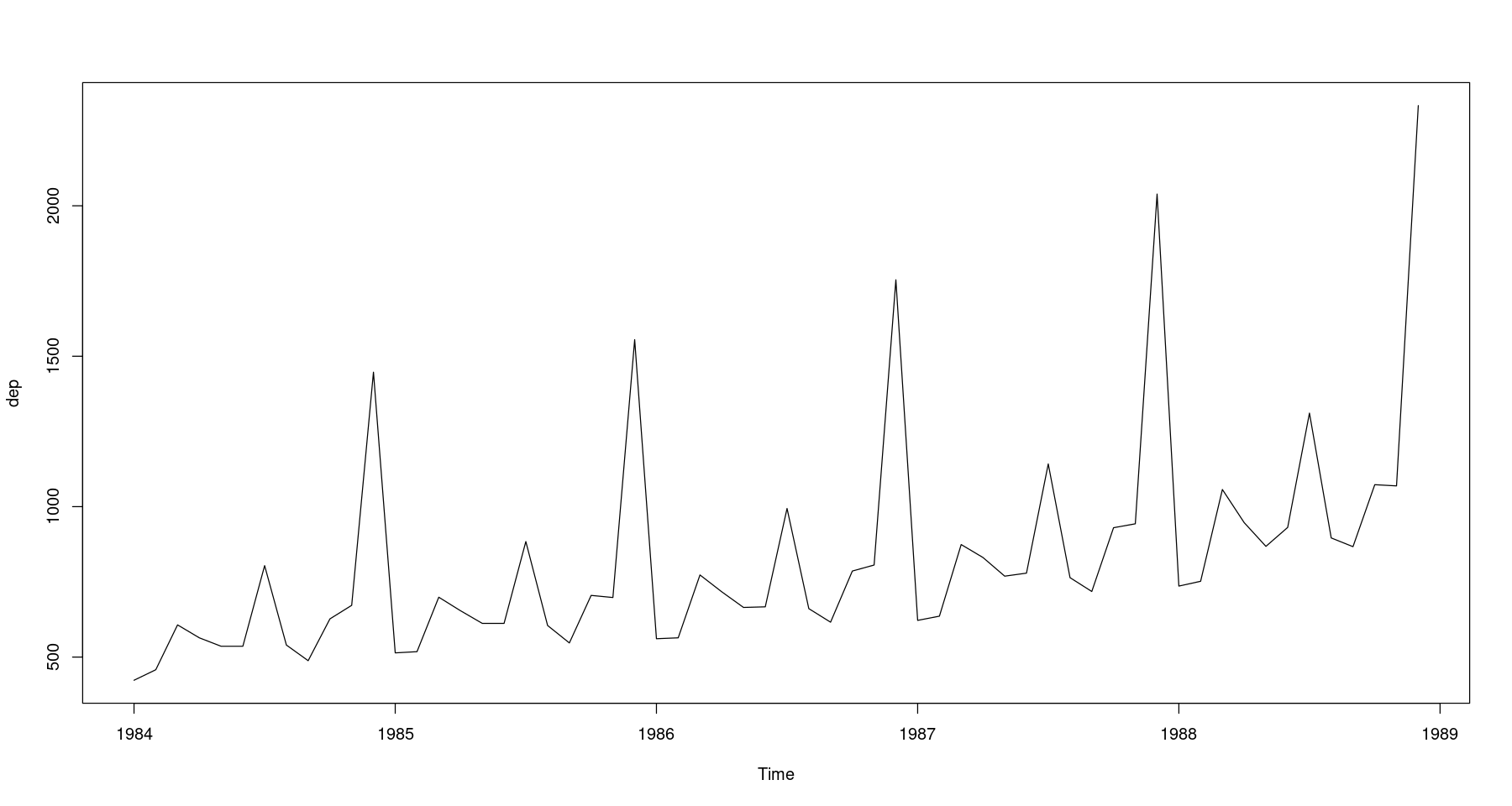

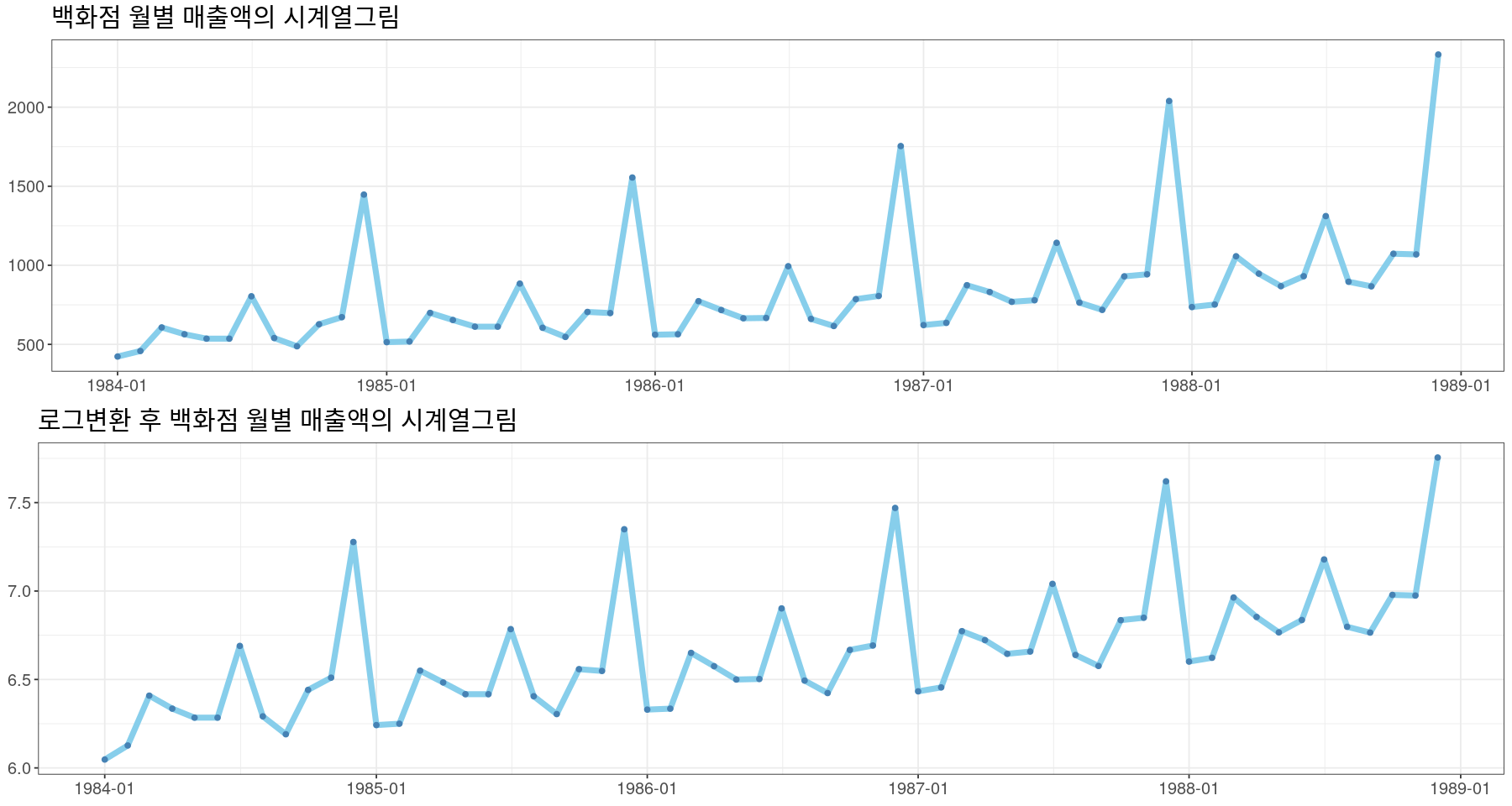

백화점 매출액 - 지시함수 사용

z <-scan("depart.txt")

head(z)- 423

- 458

- 607

- 564

- 536

- 536

dep <- ts(z, frequency=12, start=c(1984,1)) # 1984년 1월부터 시작

plot(dep)

- 약간 이분산성이 있어보인다. 로그변환이나 박스콕스변환을 하자.

class(dep)cycle(dep)| Jan | Feb | Mar | Apr | May | Jun | Jul | Aug | Sep | Oct | Nov | Dec | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 1984 | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 | 11 | 12 |

| 1985 | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 | 11 | 12 |

| 1986 | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 | 11 | 12 |

| 1987 | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 | 11 | 12 |

| 1988 | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 | 11 | 12 |

강의 영상..

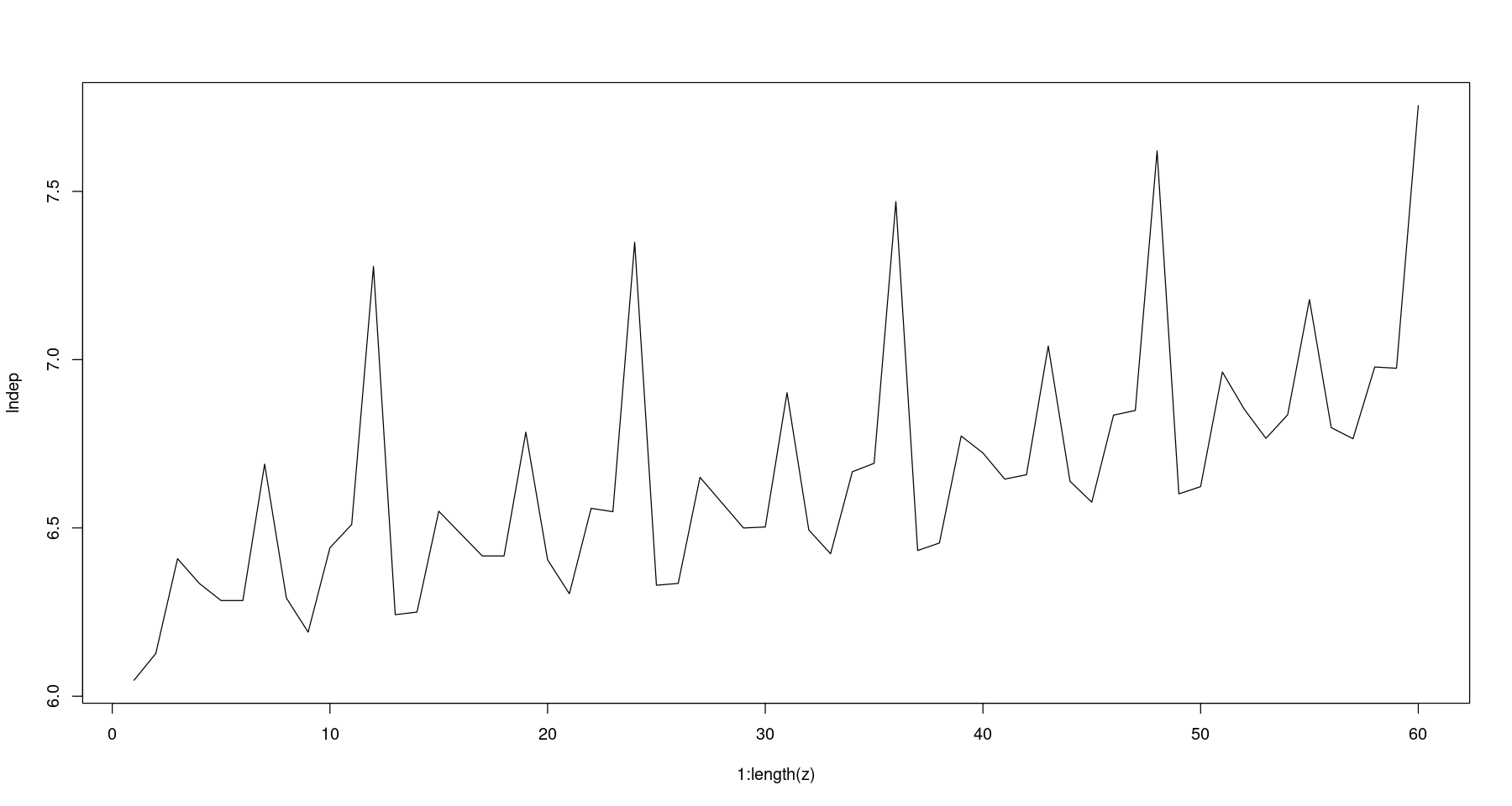

lndep <- log(z)plot(1:length(z), lndep, type='l')

- 등분산이 일정해 보인다.

trend <- 1:length(z)

trend # 추세를 넣기 위해서 trend라는 변수 생성- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10

- 11

- 12

- 13

- 14

- 15

- 16

- 17

- 18

- 19

- 20

- 21

- 22

- 23

- 24

- 25

- 26

- 27

- 28

- 29

- 30

- 31

- 32

- 33

- 34

- 35

- 36

- 37

- 38

- 39

- 40

- 41

- 42

- 43

- 44

- 45

- 46

- 47

- 48

- 49

- 50

- 51

- 52

- 53

- 54

- 55

- 56

- 57

- 58

- 59

- 60

reg <- lm(lndep ~ trend)

summary(reg)

Call:

lm(formula = lndep ~ trend)

Residuals:

Min 1Q Median 3Q Max

-0.29916 -0.17726 -0.05602 0.04315 0.85621

Coefficients:

Estimate Std. Error t value Pr(>|t|)

(Intercept) 6.271723 0.073109 85.786 < 2e-16 ***

trend 0.012443 0.002084 5.969 1.53e-07 ***

---

Signif. codes: 0 ‘***’ 0.001 ‘**’ 0.01 ‘*’ 0.05 ‘.’ 0.1 ‘ ’ 1

Residual standard error: 0.2796 on 58 degrees of freedom

Multiple R-squared: 0.3806, Adjusted R-squared: 0.3699

F-statistic: 35.63 on 1 and 58 DF, p-value: 1.531e-07- 1차 선형 모형

reg <- lm(lndep ~ trend + cycle(dep)) # 주기함수가 cycle이라 했으니, cycle을 넣어주면 될까 하고 넣어보자!

summary(reg)

Call:

lm(formula = lndep ~ trend + cycle(dep))

Residuals:

Min 1Q Median 3Q Max

-0.36677 -0.16421 -0.04285 0.12101 0.57652

Coefficients:

Estimate Std. Error t value Pr(>|t|)

(Intercept) 6.034507 0.077684 77.680 < 2e-16 ***

trend 0.010660 0.001789 5.958 1.68e-07 ***

cycle(dep) 0.044858 0.008976 4.998 5.85e-06 ***

---

Signif. codes: 0 ‘***’ 0.001 ‘**’ 0.01 ‘*’ 0.05 ‘.’ 0.1 ‘ ’ 1

Residual standard error: 0.2352 on 57 degrees of freedom

Multiple R-squared: 0.5693, Adjusted R-squared: 0.5542

F-statistic: 37.67 on 2 and 57 DF, p-value: 3.754e-11여기서 cycle은 1~12라는 수치형으로 넣어진 거라.. 범주형 변수로 바꿔줘야 한다.

reg <- lm(lndep ~ trend + as.factor(cycle(dep)))

summary(reg)

Call:

lm(formula = lndep ~ trend + as.factor(cycle(dep)))

Residuals:

Min 1Q Median 3Q Max

-0.038679 -0.018689 -0.001468 0.015185 0.057288

Coefficients:

Estimate Std. Error t value Pr(>|t|)

(Intercept) 6.0641904 0.0122952 493.215 < 2e-16 ***

trend 0.0106603 0.0001925 55.388 < 2e-16 ***

as.factor(cycle(dep))2 0.0166091 0.0160024 1.038 0.3046

as.factor(cycle(dep))3 0.3169279 0.0160059 19.801 < 2e-16 ***

as.factor(cycle(dep))4 0.2311551 0.0160117 14.437 < 2e-16 ***

as.factor(cycle(dep))5 0.1490488 0.0160198 9.304 3.12e-12 ***

as.factor(cycle(dep))6 0.1555867 0.0160302 9.706 8.32e-13 ***

as.factor(cycle(dep))7 0.5243161 0.0160429 32.682 < 2e-16 ***

as.factor(cycle(dep))8 0.1200927 0.0160579 7.479 1.54e-09 ***

as.factor(cycle(dep))9 0.0359244 0.0160752 2.235 0.0302 *

as.factor(cycle(dep))10 0.2692601 0.0160948 16.730 < 2e-16 ***

as.factor(cycle(dep))11 0.2775212 0.0161166 17.220 < 2e-16 ***

as.factor(cycle(dep))12 1.0462912 0.0161407 64.823 < 2e-16 ***

---

Signif. codes: 0 ‘***’ 0.001 ‘**’ 0.01 ‘*’ 0.05 ‘.’ 0.1 ‘ ’ 1

Residual standard error: 0.0253 on 47 degrees of freedom

Multiple R-squared: 0.9959, Adjusted R-squared: 0.9948

F-statistic: 949.2 on 12 and 47 DF, p-value: < 2.2e-16근데 위에 좀 안이쁘니까 밑에 tmp.data라는 함수를 만들자.

tmp.data <- data.frame(

dep = z,

lndep = log(z),

day = seq(ymd("1984-01-01"), by = "1 month", length.out = length(z)),

s = as.factor(cycle(dep)),

t = 1:length(z)

)

head(tmp.data)| dep | lndep | day | s | t | |

|---|---|---|---|---|---|

| <dbl> | <dbl> | <date> | <fct> | <int> | |

| 1 | 423 | 6.047372 | 1984-01-01 | 1 | 1 |

| 2 | 458 | 6.126869 | 1984-02-01 | 2 | 2 |

| 3 | 607 | 6.408529 | 1984-03-01 | 3 | 3 |

| 4 | 564 | 6.335054 | 1984-04-01 | 4 | 4 |

| 5 | 536 | 6.284134 | 1984-05-01 | 5 | 5 |

| 6 | 536 | 6.284134 | 1984-06-01 | 6 | 6 |

- 가변수를 넣을 때는 factor로!!

reg <- lm(lndep ~ t+s, tmp.data)

summary(reg)

Call:

lm(formula = lndep ~ t + s, data = tmp.data)

Residuals:

Min 1Q Median 3Q Max

-0.038679 -0.018689 -0.001468 0.015185 0.057288

Coefficients:

Estimate Std. Error t value Pr(>|t|)

(Intercept) 6.0641904 0.0122952 493.215 < 2e-16 ***

t 0.0106603 0.0001925 55.388 < 2e-16 ***

s2 0.0166091 0.0160024 1.038 0.3046

s3 0.3169279 0.0160059 19.801 < 2e-16 ***

s4 0.2311551 0.0160117 14.437 < 2e-16 ***

s5 0.1490488 0.0160198 9.304 3.12e-12 ***

s6 0.1555867 0.0160302 9.706 8.32e-13 ***

s7 0.5243161 0.0160429 32.682 < 2e-16 ***

s8 0.1200927 0.0160579 7.479 1.54e-09 ***

s9 0.0359244 0.0160752 2.235 0.0302 *

s10 0.2692601 0.0160948 16.730 < 2e-16 ***

s11 0.2775212 0.0161166 17.220 < 2e-16 ***

s12 1.0462912 0.0161407 64.823 < 2e-16 ***

---

Signif. codes: 0 ‘***’ 0.001 ‘**’ 0.01 ‘*’ 0.05 ‘.’ 0.1 ‘ ’ 1

Residual standard error: 0.0253 on 47 degrees of freedom

Multiple R-squared: 0.9959, Adjusted R-squared: 0.9948

F-statistic: 949.2 on 12 and 47 DF, p-value: < 2.2e-16- 강의자료에서 있었던 제약조건을 생각하자.

beta0=0/beta1=0/sum_beta=0

위의 제약조건에서 아무런 내용이 없으면 beta1=0을 default로 설정함

- 위의 summary 1월이 기준이므로

s2의 0.0166091 는 1월보다 이만큼 더 팔린다는 뜻이고..

s3의 0.3169279 는 1월보다 0.3만큼 더 팔린다는 뜻!

다른 것들은 거의 다 유의한데 s2는 별로 유의하지 않다. -> 왜? 1월과 2월의 시간차가 별로 없기 떄문에.. 1월보다 이만큼 더 팔리긴 하지만 통계적으로 더 유의하진 않아~ 라는 말.

reg2 <- lm(lndep ~ 0+t+s, tmp.data) # 제약조건에서 beta0=0으로 놓는다는 뜻. 절편을 0으로!

summary(reg2)

Call:

lm(formula = lndep ~ 0 + t + s, data = tmp.data)

Residuals:

Min 1Q Median 3Q Max

-0.038679 -0.018689 -0.001468 0.015185 0.057288

Coefficients:

Estimate Std. Error t value Pr(>|t|)

t 0.0106603 0.0001925 55.39 <2e-16 ***

s1 6.0641904 0.0122952 493.21 <2e-16 ***

s2 6.0807995 0.0123718 491.50 <2e-16 ***

s3 6.3811183 0.0124509 512.50 <2e-16 ***

s4 6.2953455 0.0125325 502.32 <2e-16 ***

s5 6.2132392 0.0126164 492.47 <2e-16 ***

s6 6.2197771 0.0127027 489.64 <2e-16 ***

s7 6.5885065 0.0127914 515.08 <2e-16 ***

s8 6.1842831 0.0128823 480.06 <2e-16 ***

s9 6.1001148 0.0129754 470.13 <2e-16 ***

s10 6.3334505 0.0130707 484.56 <2e-16 ***

s11 6.3417116 0.0131681 481.60 <2e-16 ***

s12 7.1104816 0.0132676 535.93 <2e-16 ***

---

Signif. codes: 0 ‘***’ 0.001 ‘**’ 0.01 ‘*’ 0.05 ‘.’ 0.1 ‘ ’ 1

Residual standard error: 0.0253 on 47 degrees of freedom

Multiple R-squared: 1, Adjusted R-squared: 1

F-statistic: 3.199e+05 on 13 and 47 DF, p-value: < 2.2e-16- intersept가 없어짐!

s1이 의미하는 것은 1월 판매량의 평균

s2가 의미하는 것은 2월 판매량의 평균

모형의 유의하냐는 0이냐 그걸로 하는거라서 다 유의하다 나옴!

위에랑 차이는 계수 해석 조심하기.

reg3 <- lm(lndep ~ t+s, tmp.data,

contrast = list(s="contr.sum"))

summary(reg3)

Call:

lm(formula = lndep ~ t + s, data = tmp.data, contrasts = list(s = "contr.sum"))

Residuals:

Min 1Q Median 3Q Max

-0.038679 -0.018689 -0.001468 0.015185 0.057288

Coefficients:

Estimate Std. Error t value Pr(>|t|)

(Intercept) 6.3260849 0.0067177 941.703 < 2e-16 ***

t 0.0106603 0.0001925 55.388 < 2e-16 ***

s1 -0.2618944 0.0108845 -24.061 < 2e-16 ***

s2 -0.2452853 0.0108675 -22.571 < 2e-16 ***

s3 0.0550335 0.0108538 5.070 6.63e-06 ***

s4 -0.0307393 0.0108436 -2.835 0.00674 **

s5 -0.1128456 0.0108368 -10.413 8.53e-14 ***

s6 -0.1063078 0.0108334 -9.813 5.87e-13 ***

s7 0.2624217 0.0108334 24.223 < 2e-16 ***

s8 -0.1418018 0.0108368 -13.085 < 2e-16 ***

s9 -0.2259700 0.0108436 -20.839 < 2e-16 ***

s10 0.0073656 0.0108538 0.679 0.50071

s11 0.0156268 0.0108675 1.438 0.15708

---

Signif. codes: 0 ‘***’ 0.001 ‘**’ 0.01 ‘*’ 0.05 ‘.’ 0.1 ‘ ’ 1

Residual standard error: 0.0253 on 47 degrees of freedom

Multiple R-squared: 0.9959, Adjusted R-squared: 0.9948

F-statistic: 949.2 on 12 and 47 DF, p-value: < 2.2e-16위의 코드는 제약 조건 중에 sum_beta=0인것을 의미함

엇? s12가 없다! s12 = -(s1+ … + s11) 로 해석하면 됨

head(data.frame(hat_y1 = fitted(reg),

hat_y2 = fitted(reg2),

hat_y3 = fitted(reg3)))| hat_y1 | hat_y2 | hat_y3 | |

|---|---|---|---|

| <dbl> | <dbl> | <dbl> | |

| 1 | 6.074851 | 6.074851 | 6.074851 |

| 2 | 6.102120 | 6.102120 | 6.102120 |

| 3 | 6.413099 | 6.413099 | 6.413099 |

| 4 | 6.337987 | 6.337987 | 6.337987 |

| 5 | 6.266541 | 6.266541 | 6.266541 |

| 6 | 6.283739 | 6.283739 | 6.283739 |

어떤 제약조건을 써도 fitted의 값은 똑같다! 계수 설명만 다름

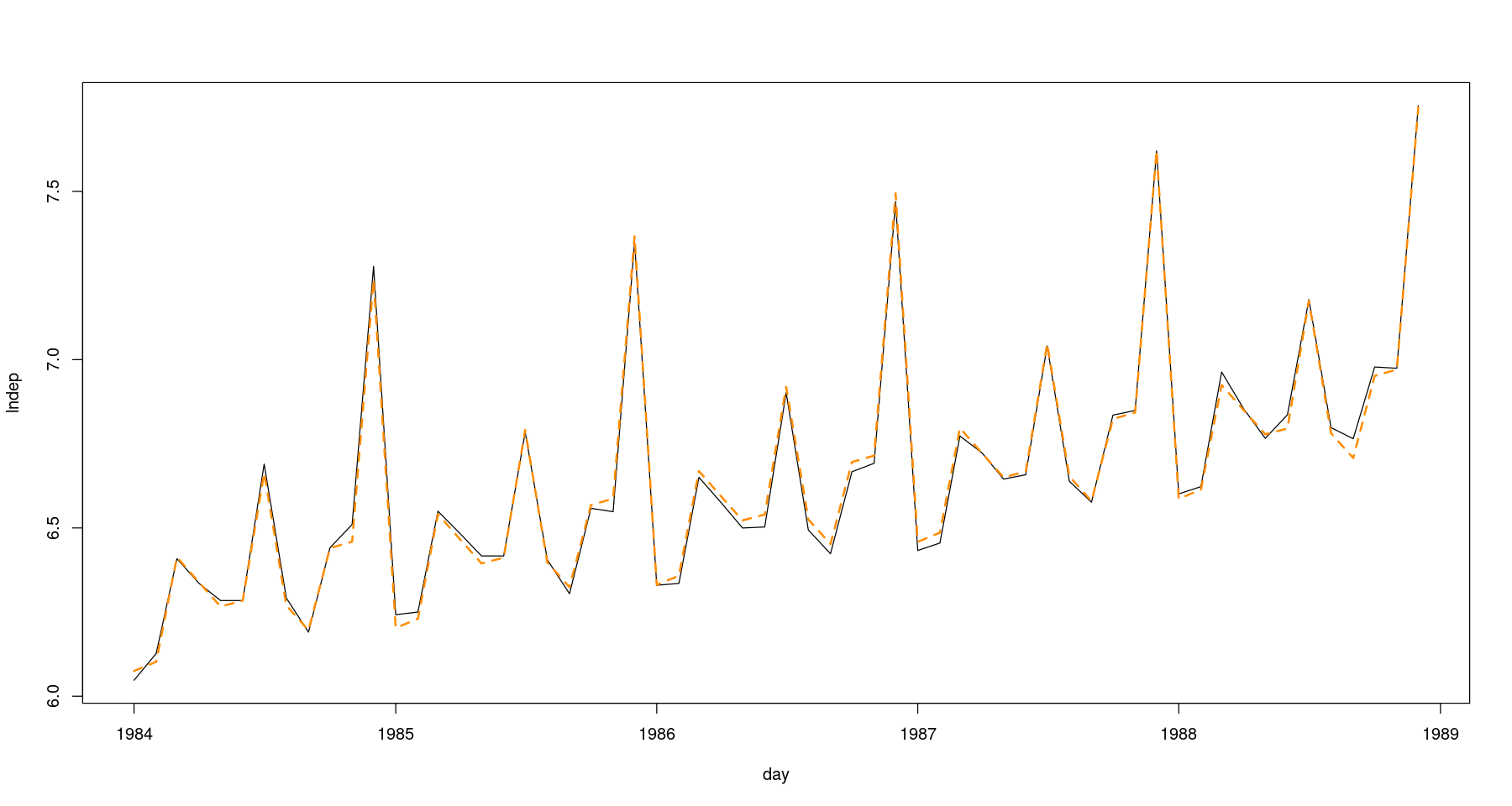

plot(lndep ~ day, tmp.data, type='l')

lines(tmp.data$day, fitted(reg), col='darkorange', lty=2, lwd=2)

- 실제값과 fittied value가 유사하게 가는 걸 확인할 수 있다.

강의 자료

tmp.data <- data.frame(

day = seq(ymd("1984-01-01"),

by='1 month', length.out=length(z)),

z=z

)head(tmp.data)| day | z | |

|---|---|---|

| <date> | <dbl> | |

| 1 | 1984-01-01 | 423 |

| 2 | 1984-02-01 | 458 |

| 3 | 1984-03-01 | 607 |

| 4 | 1984-04-01 | 564 |

| 5 | 1984-05-01 | 536 |

| 6 | 1984-06-01 | 536 |

tmp.data$lndep <- log(z) #로그변환

tmp.data$y <- as.factor(as.integer(cycle(dep))) #지시함수로 사용할 주기

tmp.data$trend <- 1:length(z) #시간 변수 생성head(tmp.data)| day | z | lndep | y | trend | |

|---|---|---|---|---|---|

| <date> | <dbl> | <dbl> | <fct> | <int> | |

| 1 | 1984-01-01 | 423 | 6.047372 | 1 | 1 |

| 2 | 1984-02-01 | 458 | 6.126869 | 2 | 2 |

| 3 | 1984-03-01 | 607 | 6.408529 | 3 | 3 |

| 4 | 1984-04-01 | 564 | 6.335054 | 4 | 4 |

| 5 | 1984-05-01 | 536 | 6.284134 | 5 | 5 |

| 6 | 1984-06-01 | 536 | 6.284134 | 6 | 6 |

p1 <- ggplot(tmp.data, aes(day, z)) +

geom_line(col='skyblue', lwd=2) +

geom_point(col='steelblue', cex=1.5)+

scale_x_date(date_breaks = "1 year", date_labels = "%Y-%m") +

ggtitle("백화점 월별 매출액의 시계열그림") +

theme_bw()+

theme(axis.text = element_text(size =12),

axis.title = element_blank(),

title = element_text(size = 15))

p2 <- ggplot(tmp.data, aes(day, lndep)) +

geom_line(col='skyblue', lwd=2) +

geom_point(col='steelblue', cex=1.5)+

scale_x_date(date_breaks = "1 year", date_labels = "%Y-%m") +

ggtitle("로그변환 후 백화점 월별 매출액의 시계열그림") +

theme_bw()+

theme(axis.text = element_text(size =12),

axis.title=element_blank(),

title = element_text(size = 15))

grid.arrange(p1,p2,nrow=2)

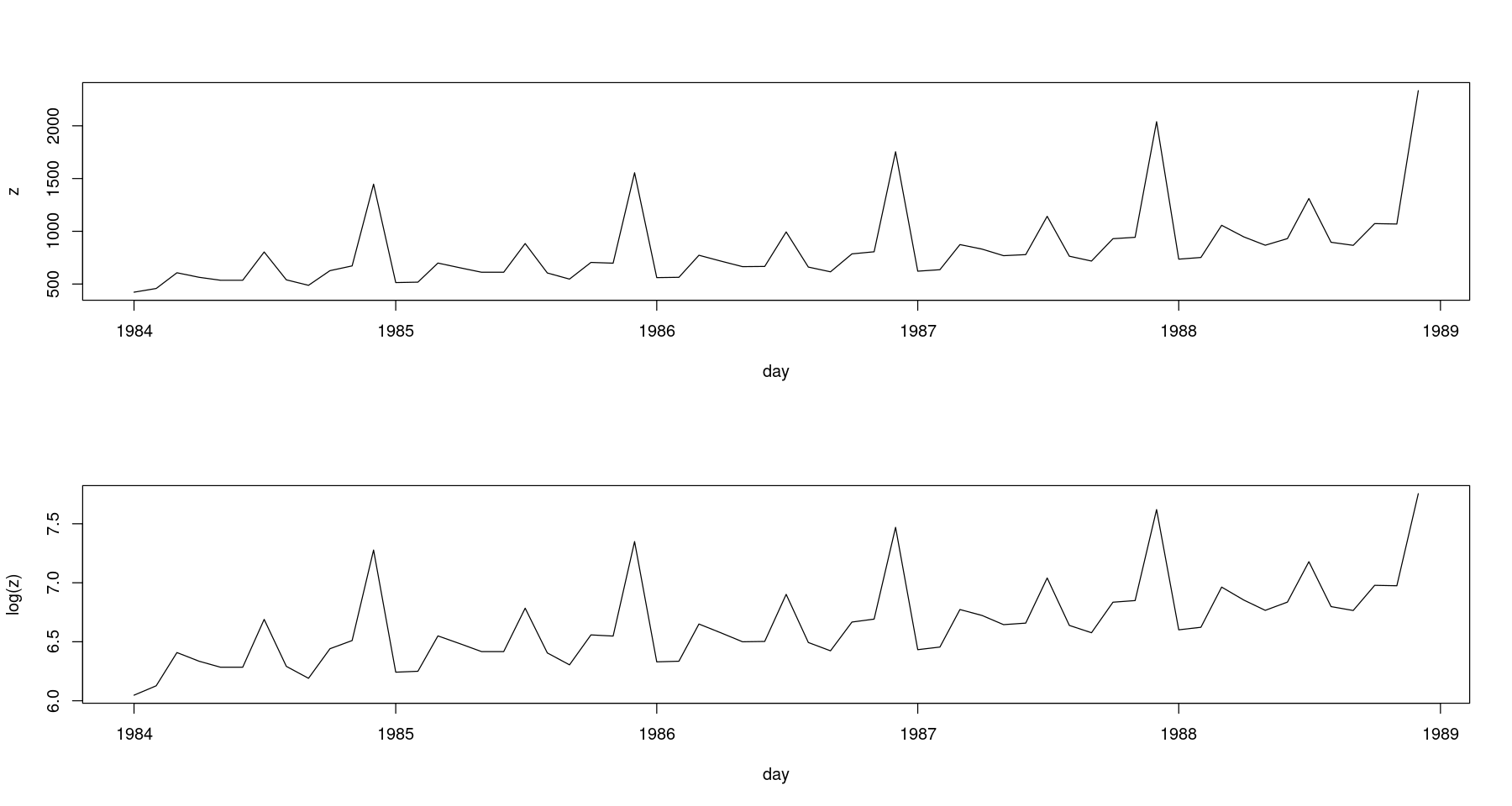

par(mfrow=c(2,1))

plot(z~day, tmp.data, type='l')

plot(log(z)~day, tmp.data, type='l')

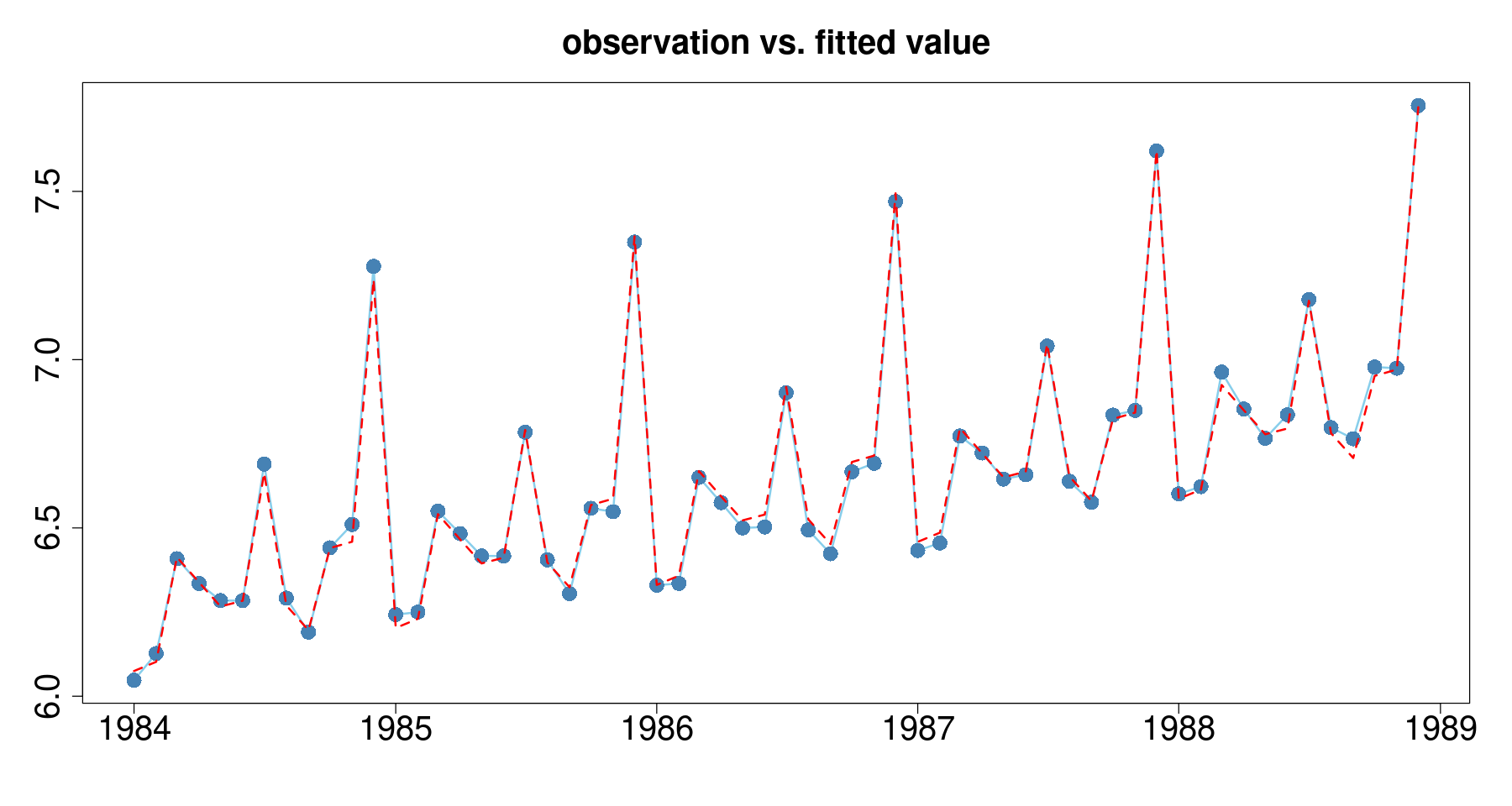

- 모형 적합: \(log(Z_t) = \beta_{trend}t + \beta_1 I_{t,1} + \dots + \beta_{12} I_{t,12} + \epsilon_t (\beta_0=0)\)

reg <- lm(lndep ~ 0 + trend+y, data=tmp.data ) #beta_0 = 0

summary(reg)

Call:

lm(formula = lndep ~ 0 + trend + y, data = tmp.data)

Residuals:

Min 1Q Median 3Q Max

-0.038679 -0.018689 -0.001468 0.015185 0.057288

Coefficients:

Estimate Std. Error t value Pr(>|t|)

trend 0.0106603 0.0001925 55.39 <2e-16 ***

y1 6.0641904 0.0122952 493.21 <2e-16 ***

y2 6.0807995 0.0123718 491.50 <2e-16 ***

y3 6.3811183 0.0124509 512.50 <2e-16 ***

y4 6.2953455 0.0125325 502.32 <2e-16 ***

y5 6.2132392 0.0126164 492.47 <2e-16 ***

y6 6.2197771 0.0127027 489.64 <2e-16 ***

y7 6.5885065 0.0127914 515.08 <2e-16 ***

y8 6.1842831 0.0128823 480.06 <2e-16 ***

y9 6.1001148 0.0129754 470.13 <2e-16 ***

y10 6.3334505 0.0130707 484.56 <2e-16 ***

y11 6.3417116 0.0131681 481.60 <2e-16 ***

y12 7.1104816 0.0132676 535.93 <2e-16 ***

---

Signif. codes: 0 ‘***’ 0.001 ‘**’ 0.01 ‘*’ 0.05 ‘.’ 0.1 ‘ ’ 1

Residual standard error: 0.0253 on 47 degrees of freedom

Multiple R-squared: 1, Adjusted R-squared: 1

F-statistic: 3.199e+05 on 13 and 47 DF, p-value: < 2.2e-16- 모형 적합: \(log(Z_t) = \beta_0+ \beta_{trend}t + \beta_2 I_{t,2} + \dots + \beta_{12} I_{t,12} + \epsilon_t (\beta_1=0)\)

reg2 <- lm(lndep ~ trend+y, data=tmp.data ) #beta_1=0

summary(reg2)

Call:

lm(formula = lndep ~ trend + y, data = tmp.data)

Residuals:

Min 1Q Median 3Q Max

-0.038679 -0.018689 -0.001468 0.015185 0.057288

Coefficients:

Estimate Std. Error t value Pr(>|t|)

(Intercept) 6.0641904 0.0122952 493.215 < 2e-16 ***

trend 0.0106603 0.0001925 55.388 < 2e-16 ***

y2 0.0166091 0.0160024 1.038 0.3046

y3 0.3169279 0.0160059 19.801 < 2e-16 ***

y4 0.2311551 0.0160117 14.437 < 2e-16 ***

y5 0.1490488 0.0160198 9.304 3.12e-12 ***

y6 0.1555867 0.0160302 9.706 8.32e-13 ***

y7 0.5243161 0.0160429 32.682 < 2e-16 ***

y8 0.1200927 0.0160579 7.479 1.54e-09 ***

y9 0.0359244 0.0160752 2.235 0.0302 *

y10 0.2692601 0.0160948 16.730 < 2e-16 ***

y11 0.2775212 0.0161166 17.220 < 2e-16 ***

y12 1.0462912 0.0161407 64.823 < 2e-16 ***

---

Signif. codes: 0 ‘***’ 0.001 ‘**’ 0.01 ‘*’ 0.05 ‘.’ 0.1 ‘ ’ 1

Residual standard error: 0.0253 on 47 degrees of freedom

Multiple R-squared: 0.9959, Adjusted R-squared: 0.9948

F-statistic: 949.2 on 12 and 47 DF, p-value: < 2.2e-16contrasts(tmp.data$y)| 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 | 11 | 12 | |

|---|---|---|---|---|---|---|---|---|---|---|---|

| 1 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| 2 | 1 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| 3 | 0 | 1 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| 4 | 0 | 0 | 1 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| 5 | 0 | 0 | 0 | 1 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| 6 | 0 | 0 | 0 | 0 | 1 | 0 | 0 | 0 | 0 | 0 | 0 |

| 7 | 0 | 0 | 0 | 0 | 0 | 1 | 0 | 0 | 0 | 0 | 0 |

| 8 | 0 | 0 | 0 | 0 | 0 | 0 | 1 | 0 | 0 | 0 | 0 |

| 9 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 1 | 0 | 0 | 0 |

| 10 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 1 | 0 | 0 |

| 11 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 1 | 0 |

| 12 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 1 |

- 모형 적합: \(log(Z_t) = \beta_0+ \beta_{trend}t + \beta_1 I_{t,1} + \dots + \beta_{11} I_{t,11} + \epsilon_t (\sum_{i=1}^{12} \beta_i=0)\)

reg3 <- lm(lndep ~ trend+y, data=tmp.data,

contrasts = list(y = "contr.sum")) #sum beta_i = 0

# b1 + ... +b12 = 0 => b12 = -(b1+...+b11)

summary(reg3)

Call:

lm(formula = lndep ~ trend + y, data = tmp.data, contrasts = list(y = "contr.sum"))

Residuals:

Min 1Q Median 3Q Max

-0.038679 -0.018689 -0.001468 0.015185 0.057288

Coefficients:

Estimate Std. Error t value Pr(>|t|)

(Intercept) 6.3260849 0.0067177 941.703 < 2e-16 ***

trend 0.0106603 0.0001925 55.388 < 2e-16 ***

y1 -0.2618944 0.0108845 -24.061 < 2e-16 ***

y2 -0.2452853 0.0108675 -22.571 < 2e-16 ***

y3 0.0550335 0.0108538 5.070 6.63e-06 ***

y4 -0.0307393 0.0108436 -2.835 0.00674 **

y5 -0.1128456 0.0108368 -10.413 8.53e-14 ***

y6 -0.1063078 0.0108334 -9.813 5.87e-13 ***

y7 0.2624217 0.0108334 24.223 < 2e-16 ***

y8 -0.1418018 0.0108368 -13.085 < 2e-16 ***

y9 -0.2259700 0.0108436 -20.839 < 2e-16 ***

y10 0.0073656 0.0108538 0.679 0.50071

y11 0.0156268 0.0108675 1.438 0.15708

---

Signif. codes: 0 ‘***’ 0.001 ‘**’ 0.01 ‘*’ 0.05 ‘.’ 0.1 ‘ ’ 1

Residual standard error: 0.0253 on 47 degrees of freedom

Multiple R-squared: 0.9959, Adjusted R-squared: 0.9948

F-statistic: 949.2 on 12 and 47 DF, p-value: < 2.2e-16head(data.frame(hat_y1 = fitted(reg),

hat_y2 = fitted(reg2),

hat_y3 = fitted(reg3)))| hat_y1 | hat_y2 | hat_y3 | |

|---|---|---|---|

| <dbl> | <dbl> | <dbl> | |

| 1 | 6.074851 | 6.074851 | 6.074851 |

| 2 | 6.102120 | 6.102120 | 6.102120 |

| 3 | 6.413099 | 6.413099 | 6.413099 |

| 4 | 6.337987 | 6.337987 | 6.337987 |

| 5 | 6.266541 | 6.266541 | 6.266541 |

| 6 | 6.283739 | 6.283739 | 6.283739 |

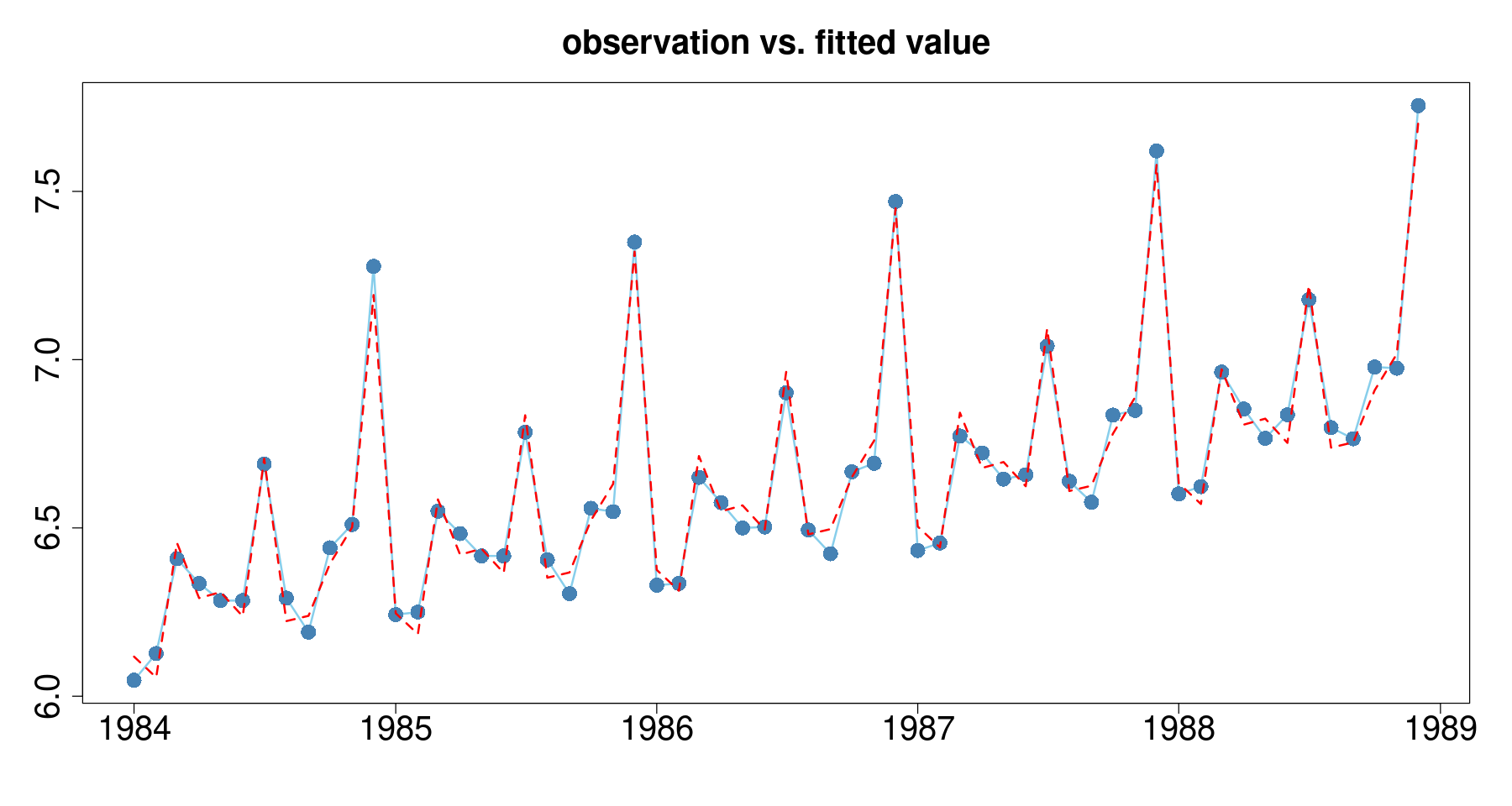

plot(lndep~day, tmp.data,

main = 'observation vs. fitted value',

xlab="", ylab="",

type='l',

col='skyblue',

lwd=2, cex.axis=2, cex.main=2) +

points(lndep~day, tmp.data, col="steelblue", cex=2, pch=16) +

lines(tmp.data$day, fitted(reg), col='red', lty=2, lwd=2)

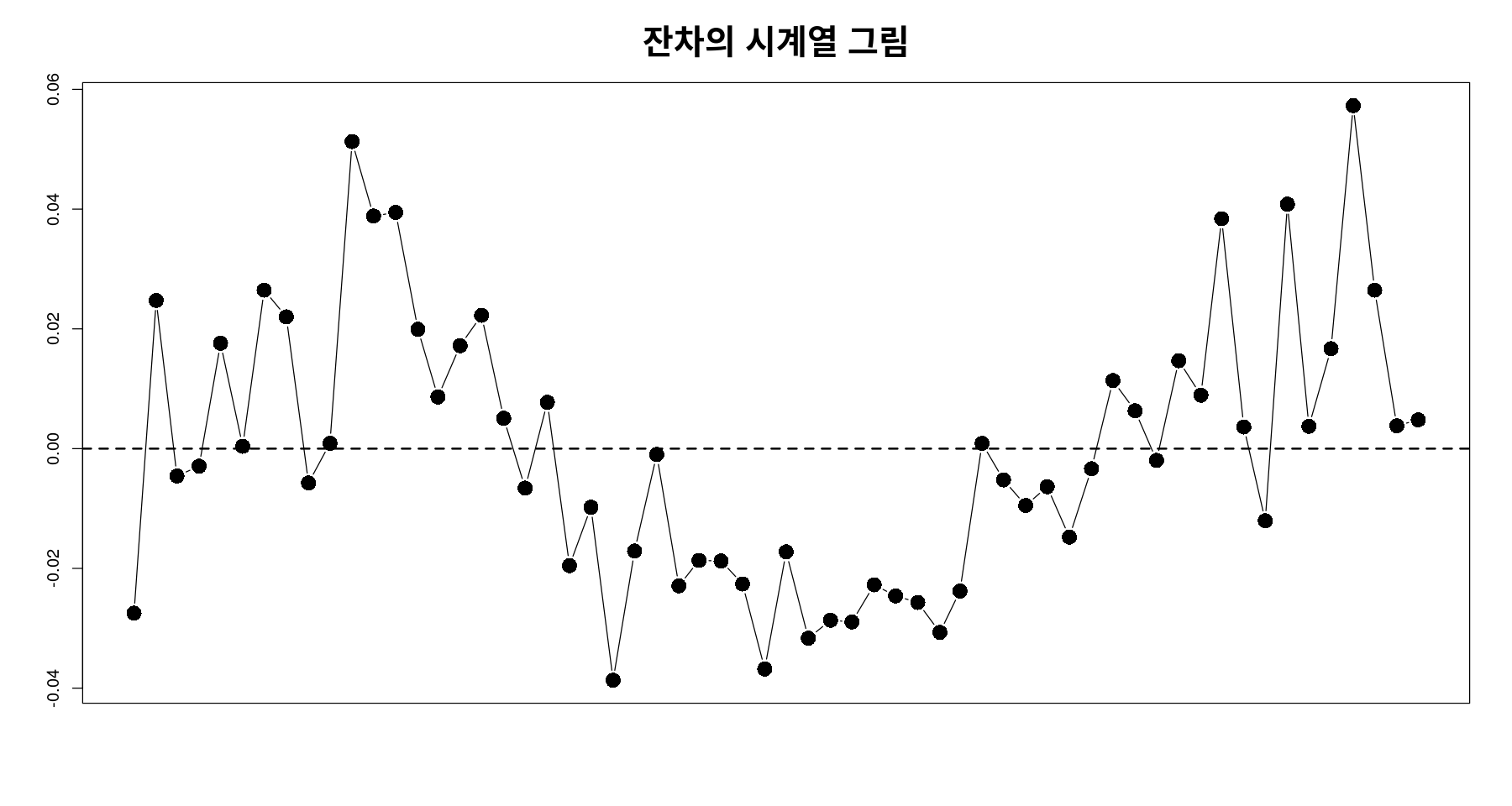

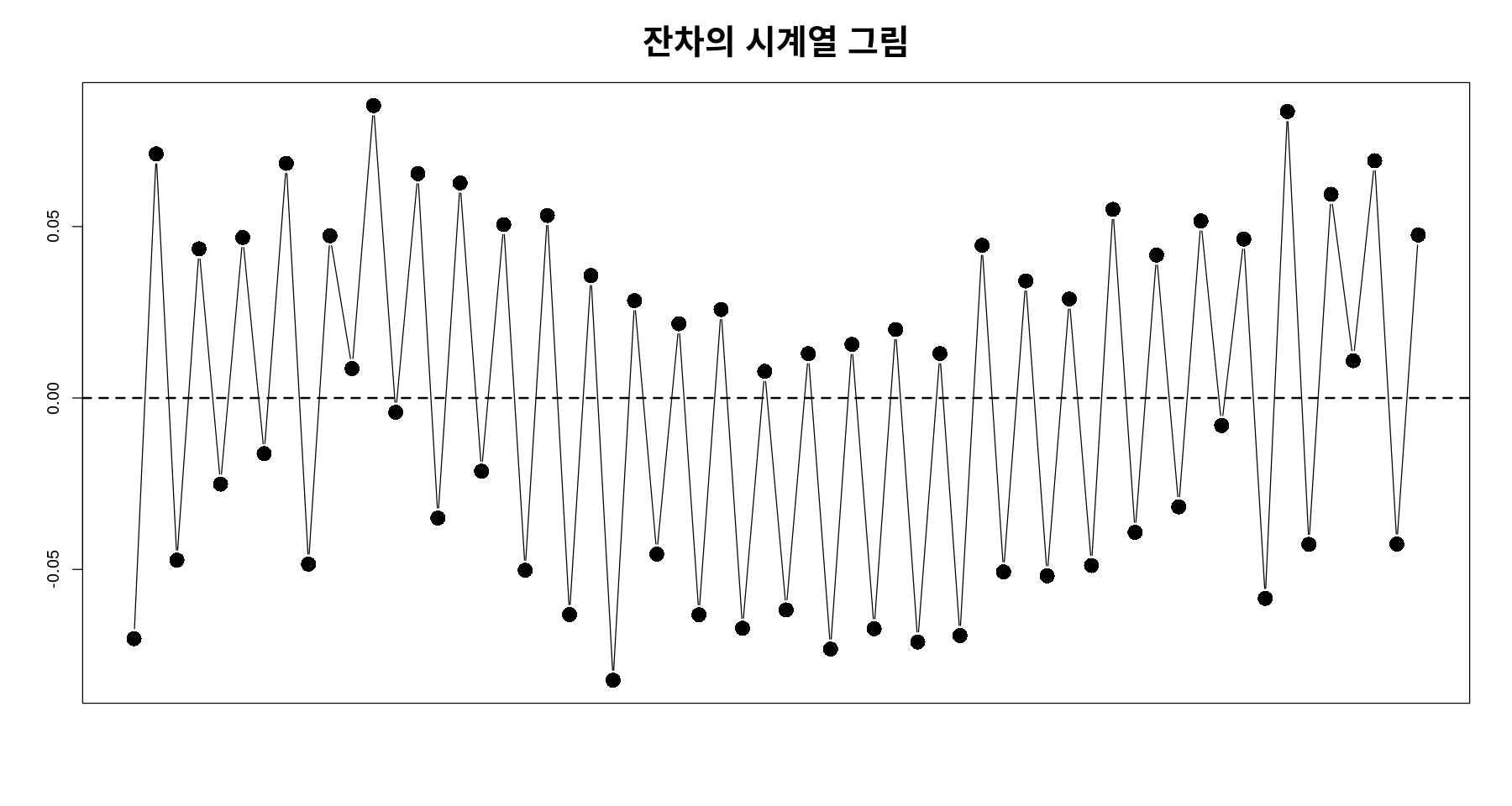

잔차 분석

plot(tmp.data$day, resid(reg),

pch=16, cex=2, xaxt='n', type='b',

xlab="", ylab="", main="잔차의 시계열 그림", cex.main=2)

abline(h=0, lty=2, lwd=2)

독립성 검정 : dW test

dwtest(reg, , alternative="two.sided")

Durbin-Watson test

data: reg

DW = 0.82642, p-value = 4.781e-06

alternative hypothesis: true autocorrelation is not 0유의확률도 작고 기각할수 있고 양의 상관관계..

dwtest(reg)

Durbin-Watson test

data: reg

DW = 0.82642, p-value = 2.39e-06

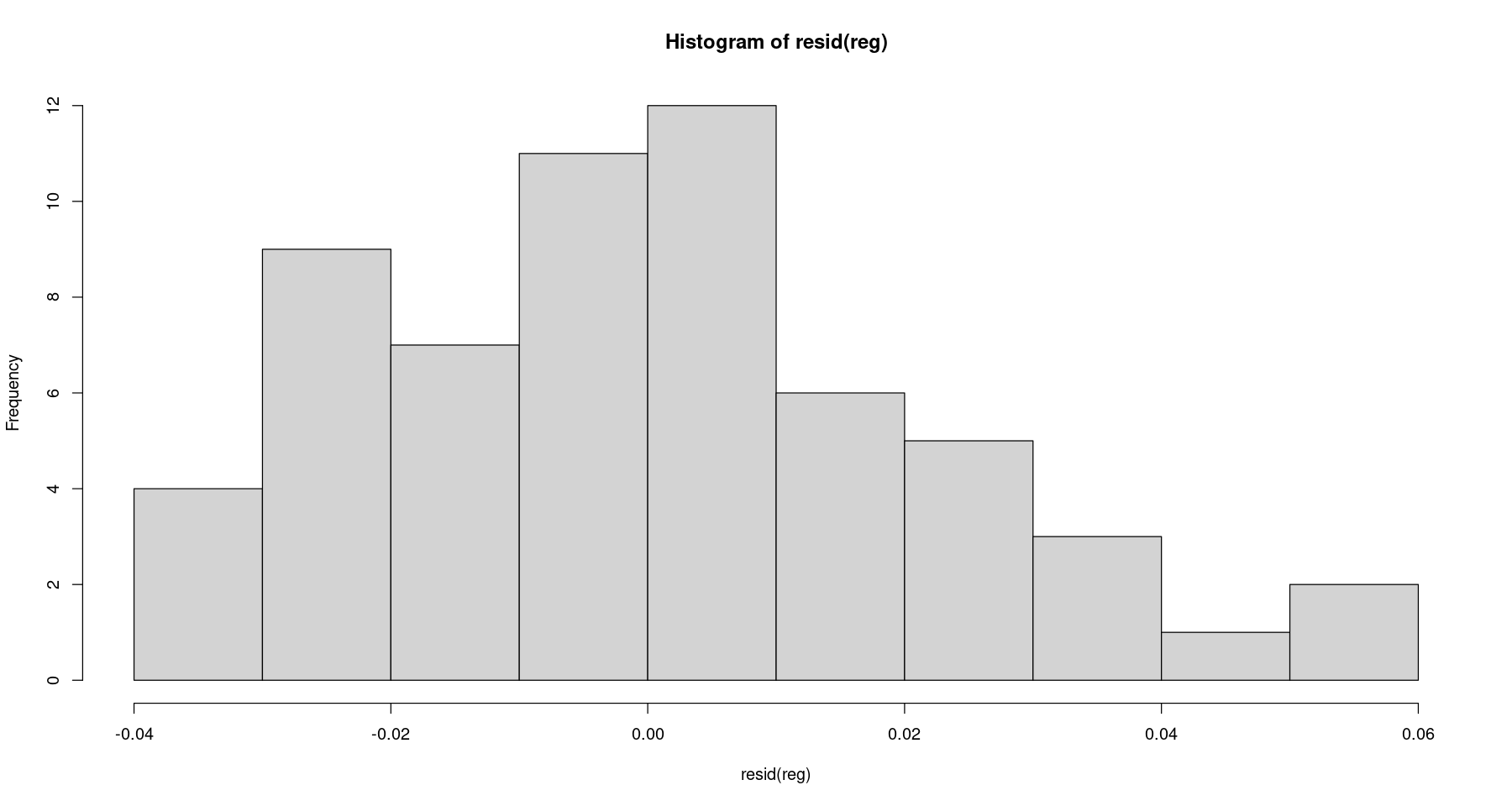

alternative hypothesis: true autocorrelation is greater than 0정규분포 검정 (shapiro-wilk test)

- 가설

\(H_0\): 정규분포를 따른다. VS \(H_1\): 정규분포를 따르지 않는다.

hist(resid(reg))

shapiro.test(resid(reg)) #H_0 : 정규분포를 따른다.

Shapiro-Wilk normality test

data: resid(reg)

W = 0.97114, p-value = 0.1659정규분포를 따른다고 보자.

등분산성검정 (Breusch–Pagan test)

- 가설

\(H_0\): 등분산 VS \(H_1\): 이분산

bptest(reg)

studentized Breusch-Pagan test

data: reg

BP = 8.1109, df = 12, p-value = 0.7764등분산성도 괜찮아 보인다.

적립값에 대한 MSE 구하기

\[MSE=\frac{1}{n} \sum_{t=1}^n (Z_t - \hat{Z_t})^2\]

오차항 제곱합에 대한 평균. 실제값과 평균값에 대하 차이를 n으로 나눈값

위에서 그림그릴때는 log값으로 했던 거니까, 실제로 실제 10년후? 20년후?를 생각할 때는 exp을 취해서 비교해주는게 원래 맞음

MSE! 그래서 밑에서 exp값 취해줌

mse1 = sum((tmp.data$dep - exp(fitted(reg)))^2)/60mse1hat_z = exp(fitted(reg))

head(hat_z)- 1

- 434.784580002858

- 2

- 446.804031754714

- 3

- 609.780567125218

- 4

- 565.656296676459

- 5

- 526.652327873636

- 6

- 535.788096351339

mse_reg_indicator <- sum((z- hat_z)^2)/length(z)

mse_reg_indicator백화점 매출액 - 삼각함수 이용

- 데이터 생성

tmp.data_2 <- data.frame(

lndep = tmp.data$lndep,

trend = tmp.data$trend)head(tmp.data_2)| lndep | trend | |

|---|---|---|

| <dbl> | <int> | |

| 1 | 6.047372 | 1 |

| 2 | 6.126869 | 2 |

| 3 | 6.408529 | 3 |

| 4 | 6.335054 | 4 |

| 5 | 6.284134 | 5 |

| 6 | 6.284134 | 6 |

dt1 <- Reduce(cbind.data.frame, lapply(as.list(1:5), function(i) sin(2*pi*i/12*tmp.data_2$trend)))

head(dt1)| init | x[[i]] | x[[i]] | x[[i]] | x[[i]] | |

|---|---|---|---|---|---|

| <dbl> | <dbl> | <dbl> | <dbl> | <dbl> | |

| 1 | 5.000000e-01 | 8.660254e-01 | 1.000000e+00 | 8.660254e-01 | 5.000000e-01 |

| 2 | 8.660254e-01 | 8.660254e-01 | 1.224647e-16 | -8.660254e-01 | -8.660254e-01 |

| 3 | 1.000000e+00 | 1.224647e-16 | -1.000000e+00 | -2.449294e-16 | 1.000000e+00 |

| 4 | 8.660254e-01 | -8.660254e-01 | -2.449294e-16 | 8.660254e-01 | -8.660254e-01 |

| 5 | 5.000000e-01 | -8.660254e-01 | 1.000000e+00 | -8.660254e-01 | 5.000000e-01 |

| 6 | 1.224647e-16 | -2.449294e-16 | 3.673940e-16 | -4.898587e-16 | 6.123234e-16 |

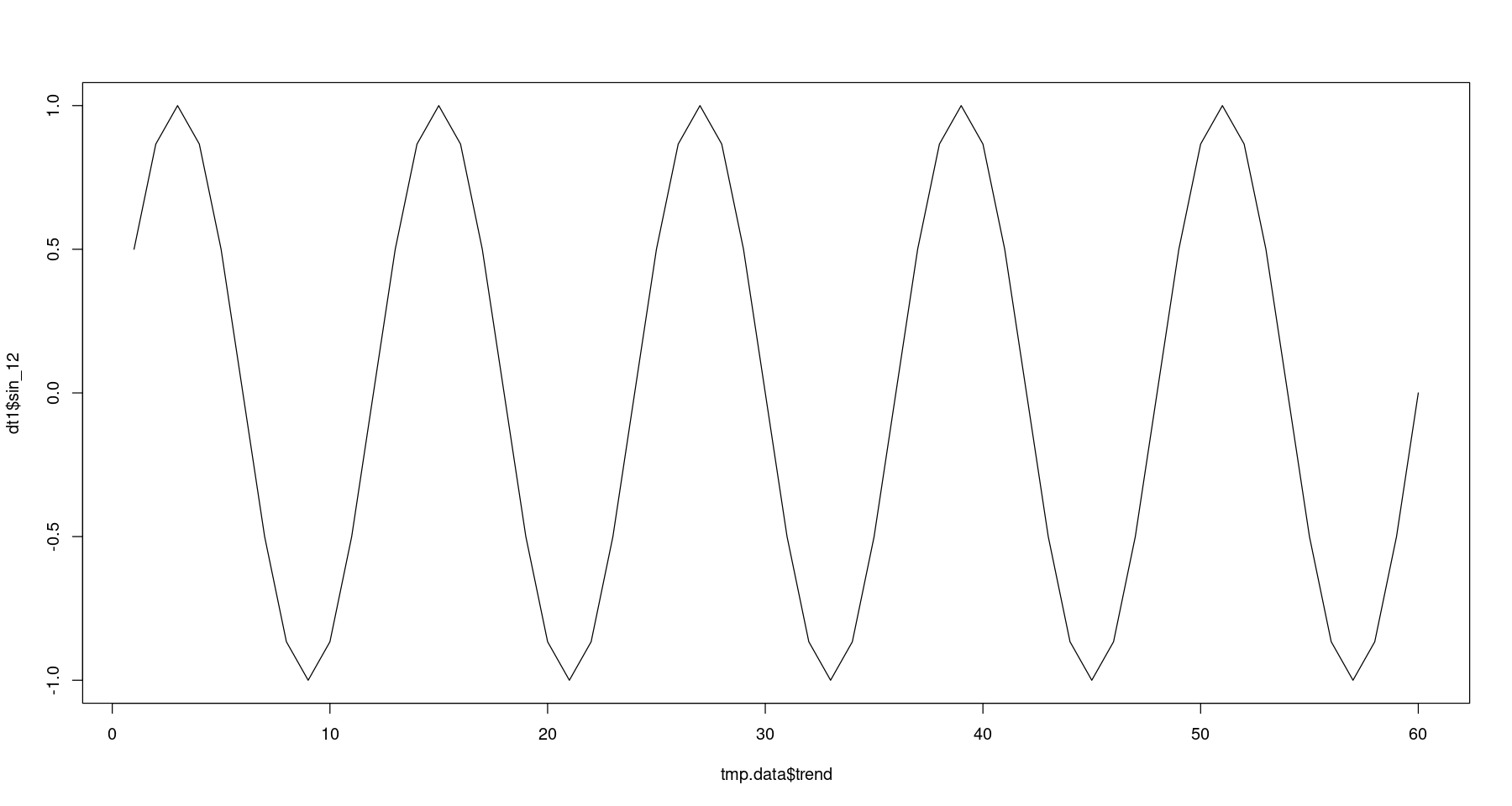

위 dataframe에서 init:사인 주기가 12인것. x[[i]]: 사인 주기가 6인거.. 주기 4 주기 3 주기 2.5? 인거까지 데이터 프레임이 들어감..

names(dt1) <- paste("sin", c(12,6,4,3,2.4), sep="_")

head(dt1)| sin_12 | sin_6 | sin_4 | sin_3 | sin_2.4 | |

|---|---|---|---|---|---|

| <dbl> | <dbl> | <dbl> | <dbl> | <dbl> | |

| 1 | 5.000000e-01 | 8.660254e-01 | 1.000000e+00 | 8.660254e-01 | 5.000000e-01 |

| 2 | 8.660254e-01 | 8.660254e-01 | 1.224647e-16 | -8.660254e-01 | -8.660254e-01 |

| 3 | 1.000000e+00 | 1.224647e-16 | -1.000000e+00 | -2.449294e-16 | 1.000000e+00 |

| 4 | 8.660254e-01 | -8.660254e-01 | -2.449294e-16 | 8.660254e-01 | -8.660254e-01 |

| 5 | 5.000000e-01 | -8.660254e-01 | 1.000000e+00 | -8.660254e-01 | 5.000000e-01 |

| 6 | 1.224647e-16 | -2.449294e-16 | 3.673940e-16 | -4.898587e-16 | 6.123234e-16 |

plot(tmp.data$trend, dt1$sin_12, type='l')

dt2 <- Reduce(cbind.data.frame, lapply(as.list(1:5), function(i) cos(2*pi*i/12*tmp.data_2$trend)))

names(dt2) <- paste("cos", c(12,6,4,3,2.4), sep="_")tmp.data_3 <- cbind.data.frame(tmp.data_2, dt1, dt2)

head(tmp.data_3)| lndep | trend | sin_12 | sin_6 | sin_4 | sin_3 | sin_2.4 | cos_12 | cos_6 | cos_4 | cos_3 | cos_2.4 | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| <dbl> | <int> | <dbl> | <dbl> | <dbl> | <dbl> | <dbl> | <dbl> | <dbl> | <dbl> | <dbl> | <dbl> | |

| 1 | 6.047372 | 1 | 5.000000e-01 | 8.660254e-01 | 1.000000e+00 | 8.660254e-01 | 5.000000e-01 | 8.660254e-01 | 0.5 | 6.123234e-17 | -0.5 | -8.660254e-01 |

| 2 | 6.126869 | 2 | 8.660254e-01 | 8.660254e-01 | 1.224647e-16 | -8.660254e-01 | -8.660254e-01 | 5.000000e-01 | -0.5 | -1.000000e+00 | -0.5 | 5.000000e-01 |

| 3 | 6.408529 | 3 | 1.000000e+00 | 1.224647e-16 | -1.000000e+00 | -2.449294e-16 | 1.000000e+00 | 6.123234e-17 | -1.0 | -1.836970e-16 | 1.0 | 3.061617e-16 |

| 4 | 6.335054 | 4 | 8.660254e-01 | -8.660254e-01 | -2.449294e-16 | 8.660254e-01 | -8.660254e-01 | -5.000000e-01 | -0.5 | 1.000000e+00 | -0.5 | -5.000000e-01 |

| 5 | 6.284134 | 5 | 5.000000e-01 | -8.660254e-01 | 1.000000e+00 | -8.660254e-01 | 5.000000e-01 | -8.660254e-01 | 0.5 | 3.061617e-16 | -0.5 | 8.660254e-01 |

| 6 | 6.284134 | 6 | 1.224647e-16 | -2.449294e-16 | 3.673940e-16 | -4.898587e-16 | 6.123234e-16 | -1.000000e+00 | 1.0 | -1.000000e+00 | 1.0 | -1.000000e+00 |

- 모형 적합

\[Z_t = \beta_0 + \beta_1 t + \sum_{i=1}^5 \{ \beta_{1,i} sin \left( \frac{2 \pi ti}{12} \right) + \beta_{2,i} cos \left( \frac{2\pi ti}{12} \right) \}\]

reg_sin <- lm(lndep ~., data=tmp.data_3)

summary(reg_sin)

Call:

lm(formula = lndep ~ ., data = tmp.data_3)

Residuals:

Min 1Q Median 3Q Max

-0.08232 -0.04855 0.00972 0.04645 0.08527

Coefficients:

Estimate Std. Error t value Pr(>|t|)

(Intercept) 6.3237250 0.0148062 427.100 < 2e-16 ***

trend 0.0107376 0.0004242 25.315 < 2e-16 ***

sin_12 -0.0277129 0.0103066 -2.689 0.009829 **

sin_6 -0.0382551 0.0102107 -3.747 0.000481 ***

sin_4 -0.1555546 0.0101931 -15.261 < 2e-16 ***

sin_3 0.0666506 0.0101872 6.543 3.70e-08 ***

sin_2.4 0.0128922 0.0101849 1.266 0.211691

cos_12 0.0857900 0.0101931 8.416 5.21e-11 ***

cos_6 0.1675743 0.0101931 16.440 < 2e-16 ***

cos_4 0.1592698 0.0101931 15.625 < 2e-16 ***

cos_3 0.1267107 0.0101931 12.431 < 2e-16 ***

cos_2.4 0.2000603 0.0101931 19.627 < 2e-16 ***

---

Signif. codes: 0 ‘***’ 0.001 ‘**’ 0.01 ‘*’ 0.05 ‘.’ 0.1 ‘ ’ 1

Residual standard error: 0.05578 on 48 degrees of freedom

Multiple R-squared: 0.9796, Adjusted R-squared: 0.9749

F-statistic: 209.5 on 11 and 48 DF, p-value: < 2.2e-16plot(lndep~tmp.data$day, tmp.data_3,

main = 'observation vs. fitted value',

xlab="", ylab="",

type='l',

col='skyblue',

lwd=2, cex.axis=2, cex.main=2) +

points(lndep~day, tmp.data, col="steelblue", cex=2, pch=16) +

lines(tmp.data$day, fitted(reg_sin), col='red', lty=2, lwd=2)

잔차분석

plot(tmp.data$day, resid(reg_sin),

pch=16, cex=2, xaxt='n', type='b',

xlab="", ylab="", main="잔차의 시계열 그림", cex.main=2)

abline(h=0, lty=2, lwd=2)

- 음의 상관관계ㅡ

독립성검정 : DW test

# DW tets

dwtest(reg_sin, alternative = "two.side")

Durbin-Watson test

data: reg_sin

DW = 3.2703, p-value = 1.269e-06

alternative hypothesis: true autocorrelation is not 0dwtest(reg_sin, alternative = "less")

Durbin-Watson test

data: reg_sin

DW = 3.2703, p-value = 6.346e-07

alternative hypothesis: true autocorrelation is less than 0mse_reg_indicator <- sum((z- hat_z)^2)/length(z)

mse_reg_indicatormse_reg_sin <- sum((z- exp(fitted(reg_sin)))^2)/length(z)

mse_reg_sin예측

new_data <- data.frame(

trend = 61:72,

y = as.factor(1:12)

)

new_data| trend | y |

|---|---|

| <int> | <fct> |

| 61 | 1 |

| 62 | 2 |

| 63 | 3 |

| 64 | 4 |

| 65 | 5 |

| 66 | 6 |

| 67 | 7 |

| 68 | 8 |

| 69 | 9 |

| 70 | 10 |

| 71 | 11 |

| 72 | 12 |

predict(reg, newdata = new_data)- 1

- 6.7144672456811

- 2

- 6.74173664641499

- 3

- 7.05271572206396

- 4

- 6.97760319970194

- 5

- 6.90615716706365

- 6

- 6.92335529591197

- 7

- 7.30274501587322

- 8

- 6.90918186129912

- 9

- 6.83567387691014

- 10

- 7.07966982631314

- 11

- 7.09859120927279

- 12

- 7.87802148673723

exp(predict(reg, newdata = new_data))- 1

- 824.244530071992

- 2

- 847.030451690602

- 3

- 1155.99384180977

- 4

- 1072.34508738392

- 5

- 998.403164382383

- 6

- 1015.7223324074

- 7

- 1484.36895660247

- 8

- 1001.42760036959

- 9

- 930.455151751132

- 10

- 1187.57634730933

- 11

- 1210.26086864202

- 12

- 2638.64679410606

predict_result <- as.data.frame(predict(reg, newdata = new_data, interval = "predict"))예측 오차

predict_result$fitted_dep <- exp(predict_result$fit)

predict_result$fitted_dep_l <- exp(predict_result$lwr)

predict_result$fitted_dep_u <- exp(predict_result$upr)

predict_result| fit | lwr | upr | fitted_dep | fitted_dep_l | fitted_dep_u | |

|---|---|---|---|---|---|---|

| <dbl> | <dbl> | <dbl> | <dbl> | <dbl> | <dbl> | |

| 1 | 6.714467 | 6.656996 | 6.771939 | 824.2445 | 778.2095 | 873.0027 |

| 2 | 6.741737 | 6.684265 | 6.799208 | 847.0305 | 799.7228 | 897.1365 |

| 3 | 7.052716 | 6.995244 | 7.110187 | 1155.9938 | 1091.4303 | 1224.3767 |

| 4 | 6.977603 | 6.920132 | 7.035075 | 1072.3451 | 1012.4534 | 1135.7797 |

| 5 | 6.906157 | 6.848686 | 6.963629 | 998.4032 | 942.6412 | 1057.4637 |

| 6 | 6.923355 | 6.865884 | 6.980827 | 1015.7223 | 958.9931 | 1075.8074 |

| 7 | 7.302745 | 7.245274 | 7.360216 | 1484.3690 | 1401.4653 | 1572.1768 |

| 8 | 6.909182 | 6.851710 | 6.966653 | 1001.4276 | 945.4967 | 1060.6671 |

| 9 | 6.835674 | 6.778202 | 6.893145 | 930.4552 | 878.4882 | 985.4962 |

| 10 | 7.079670 | 7.022198 | 7.137141 | 1187.5763 | 1121.2489 | 1257.8274 |

| 11 | 7.098591 | 7.041120 | 7.156063 | 1210.2609 | 1142.6664 | 1281.8539 |

| 12 | 7.878021 | 7.820550 | 7.935493 | 2638.6468 | 2491.2754 | 2794.7360 |

점추정/상한/하한. 왼쪽 3개는 로그값이니까 exp취해준 오른쪽 값 3개를 봐야함!

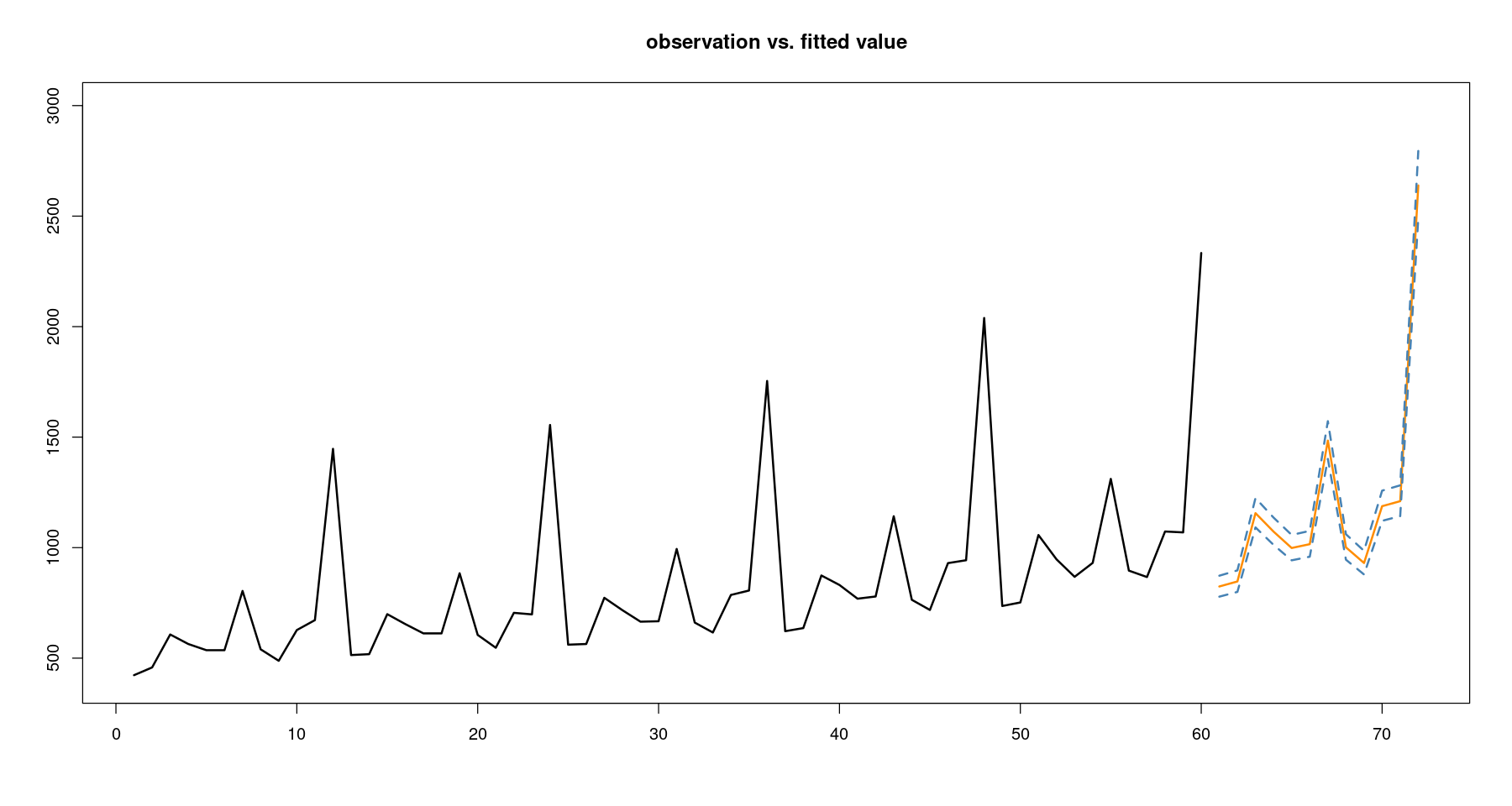

plot(z~tmp.data$trend, tmp.data,

main = 'observation vs. fitted value',

xlab="", ylab="",

xlim=c(1,72),

ylim=c(400,3000),

type='l',

lwd=2)

lines(61:72, predict_result$fitted_dep, col='darkorange', lwd=2)

lines(61:72, predict_result$fitted_dep_l, col='steelblue', lwd=2, lty=2)

lines(61:72, predict_result$fitted_dep_u, col='steelblue', lwd=2, lty=2)